What is the net income formula:

The net income formula is a company’s profit after business expenses are accounted for. It’s total revenue minus total expenses.

Bringing in revenue should be one of your top priorities as a small business owner. However, to fully understand the profitability of your business, you need to know how to calculate your net income.

Net income, also known as the “bottom line,” is the profit remaining after subtracting all business expenses from your total revenue. It reveals how much money your business makes after accounting for operational costs.

Below, we’ll define net income, explore how to calculate it, and delve into why it’s a necessary metric for understanding your business’s financial health.

Gross profit vs. Net income

Gross profit and net income should not be used interchangeably. Both gross income and net income can measure profitability, but net income provides the clearest picture. Distinguishing between gross profit and net income is crucial for business owners because it provides a more clear view of your company’s financial health.

- Gross profit: Revenue minus the cost of goods sold. Cost of goods sold (COGS) is how much it costs to maintain production or perform a service. For example, materials and utilities are part of COGS.

- Net income: Revenue minus all other expenses such as the cost of goods sold, taxes, admin expenses, and operating costs.

Understanding both gross profit margin and net income margin can significantly impact your business decisions. Gross profit margin helps you assess your pricing strategy and production efficiency. Net income, on the other hand, reflects your overall profitability, guiding investment and growth decisions for your company.

How to calculate net income

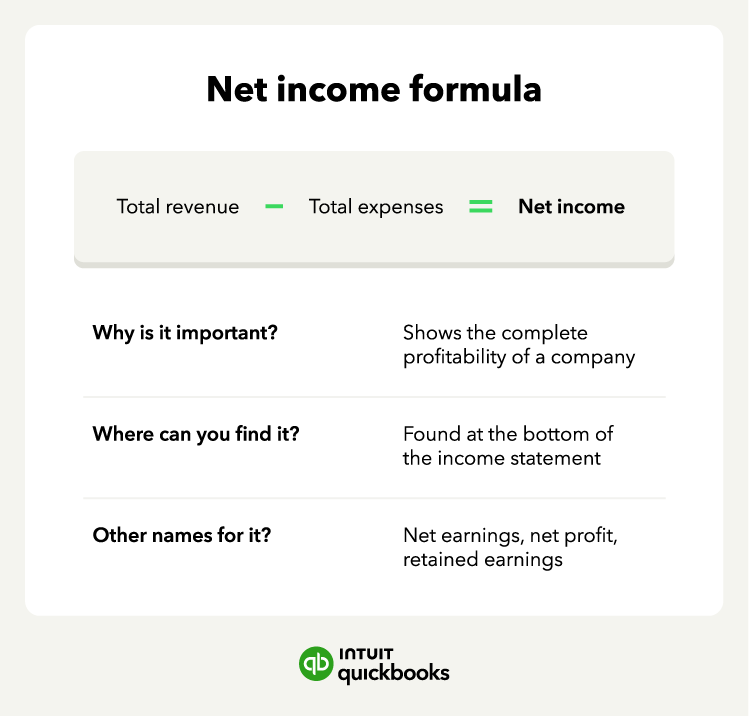

Net income (NI) is used to assess your company’s profitability. It resides at the bottom of your income statement, reflecting the profit remaining after subtracting all expenses from your total sales revenue.

To calculate net profit, you’ll use the following net income formula:

Net income = Total revenue – Total expenses

- Find your total revenue or gross income: Revenue minus the cost of goods sold).

- Determine how much you earn before taxes: Subtract your business expenses and operating costs from your gross income.

When calculating your net income, the expenses you’ll deduct expenses include:

- Cost of goods sold (COGS): The direct costs associated with producing or acquiring your products or services.

- Operating expenses: Day-to-day operational costs such as rent, utilities, salaries, marketing, and administrative expenses.

- General expenses: Miscellaneous expenses not directly tied to core operations.

- Taxes: Business taxes owed to federal, state, and local governments.

- Interest: The cost of borrowing money, like interest on loans.

- Depreciation: The gradual decrease in the value of assets over time.

- Other expenses: Any additional costs incurred by your business.

By factoring in all these expenses, net income provides a clear and concise picture of your company’s financial health and profitability. It’s the foundation for calculating earnings per share (EPS), a metric that shows how much profit is allocated to each outstanding share of stock.

This net income formula applies to both businesses and individuals, but the specific expenses factored in will differ.

Run your business with confidence

Get help and guidance when you need it from real bookkeeping experts at Eric Buchholz Bookkeeping… Get Started right HERE!

Net income of a business example

Let’s say you run a bakery, and your monthly monthly revenue is $10,000.

Here’s a breakdown of your potential expenses:

- Cost of goods sold (COGS): Flour, sugar, eggs, rent for kitchen space, etc. ($4,000)

- Operating expenses: Salaries, utilities, marketing ($3,000)

- Interest expense: Loan for a new oven ($500)

- Taxes: Business taxes imposed by federal, state, and local governments ($750)

So, here’s how you’d calculate your bakery’s net income:

$10,000 (Total Revenue) – $4,000 (COGS) – $3,000 (Operating Expenses) – $500 (Interest Expense) – $750 (Taxes)

Net Income = $1,750

This example shows that after covering all your business expenses, your bakery has a net income of $1,750 for the month.

Net income of an individual example

For an individual, calculating net income differs from business. Let’s say your gross salary is $5,000 per month. Here’s a breakdown of possible deductions:

- Federal income tax: Withheld by your employer ($1,000)

- Social Security and Medicare taxes: Withheld by your employer ($750)

- Health insurance: Paid by you to your health insurance provider ($200)

Following the formula but considering deductions instead of expenses:

Net Income (Take-Home Pay) = $5,000 (Gross Salary) – $1,000 (Taxes) – $750 (Social Security and Medicare) – $200 (Health Insurance)

Net Income = $3,050

This example shows your net income, or take-home pay, is $3,050 after accounting for deductions.

Net income formula tips

When using the net income formula, it’s important to remember what total revenue and total expenses include:

- Total revenue can also be referred to as gross income, which is your revenue minus your cost of goods sold.

- Your total expenses will include every cost you’re responsible for, including taxes, interest, debt, deductions, operating expenses, and general expenses.

With net income, you can also calculate the net profit margin by dividing your net income by revenue and multiplying it by 100 to get a percentage.

This percentage will show you how much money you bring in from each dollar of revenue.

Why is understanding net income important?

Net income gives you a better view of your company’s performance since it represents the business’s profit after deducting expenses.

A positive net income signifies profitability, demonstrating your ability to generate revenue that exceeds your expenses. Conversely, a negative net income indicates a net loss, prompting you to investigate areas for improvement.

For example, your business may show a large income at the end of a quarter, but your financial view is complete once you bring in your expenses and see the full scope of your business spending. Net income is the other piece of the profitability puzzle (the first is total income), one that companies and shareholders rely on for the most accurate information.

By tracking your expenses and net income over time, you can monitor your financial progress and identify potential issues.

Where is net income recorded?

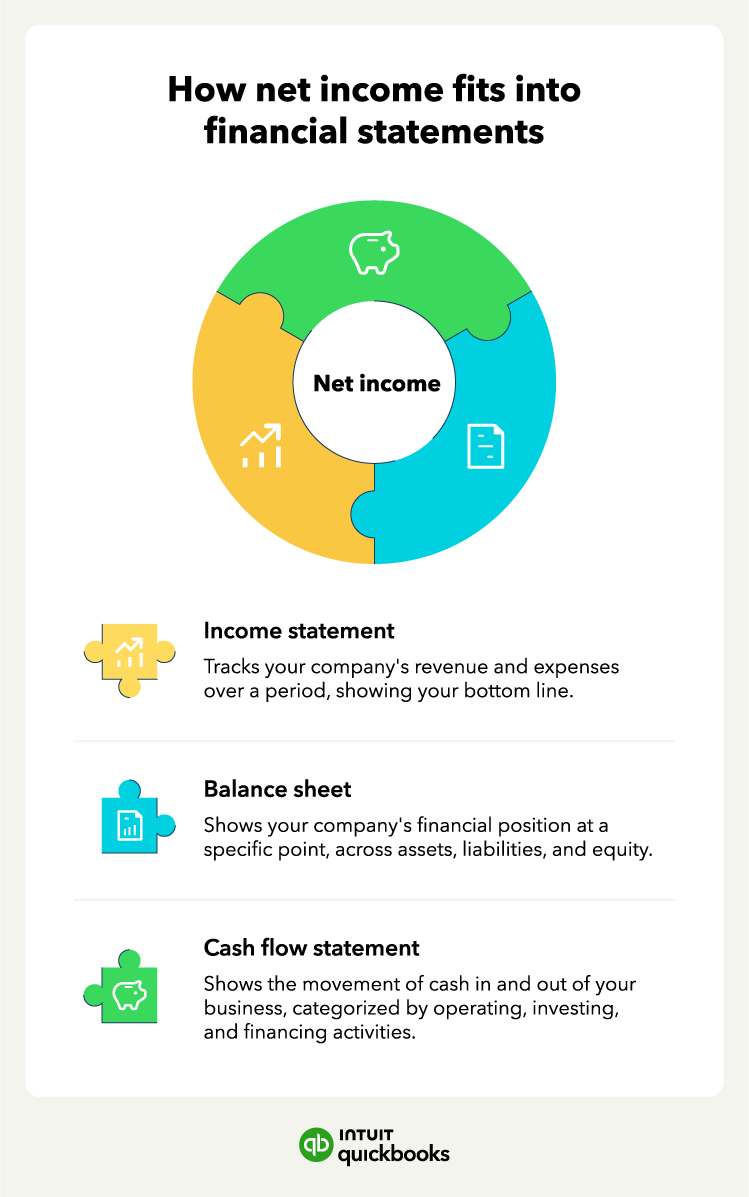

The income statement is the primary financial document for finding a business’s net income. If you’d like to review the figures that determined your net income, simply read the income statement from top to bottom.

Income statements show how profitable your company is, with profits and losses recorded over a given period—while the other two main financial statements where net income is recorded (balance sheets and cash flow statements) serve different purposes.

The beauty behind financial statements is that they all tie back to one another. And a common denominator of these statements is net income.

Here’s the breakdown of the connection:

- Income statement: Net income, also referred to as net earnings, is found at the very bottom of the income statement.

- Balance sheet: Net income will be referred to here as retained earnings and can also be found toward the bottom of the balance sheet, along with shareholders’ equity and total liabilities.

- Cash flow statement: Here, net income, or retained earnings, provides the starting point for the cash flow from the operations section.

Understanding these connections between financial statements empowers you to gain a more comprehensive view of your company’s financial health. Net income isn’t just a single figure; it’s a vital piece of the puzzle, providing valuable insights into your profitability and its impact on your overall financial picture.

Spend more time growing your business

Accounting software empowers you to take your bookkeeping to the next level. Tools like QuickBooks can significantly improve efficiency, saving valuable time and resources. Consider exploring these solutions to unlock a smoother and more efficient experience when managing your business finances.

Ready to get started?

Take routine bookkeeping off your never-ending to-do list with the help of a certified professional. At Eric Buchholz Bookkeeping, we can help ensure that your business’s books close every month, and you’re primed for tax season. Our expert certified QuickBooks ProAdvisors have over 25 years of experience working with small business bookkeeping across various industries.

Whether you’re learning where net income is recorded exactly, or why understanding net income is so important, Eric Buchholz Bookkeeping can guide you down the right path. Schedule your FREE phone consultation today!… Simply CLICK HERE.