Gross profit definition:

Gross profit is the amount of money a business makes after deducting the cost of goods sold from the total revenue. An ideal gross profit margin is 20% or higher.

Revenue is the key to business success, right? Not quite. While forecasting revenue is an important piece of financial health, gross profit is an unsung hero when analyzing your production costs—especially since inflation is a top concern for business owners in 2024. But what is gross profit exactly and how does it differ from other popular reporting metrics?

Put simply, gross profit helps you get a more accurate picture of how well your business is maintaining its production profit margins. This, in turn, can impact everything from pricing to resource allocation.

Let’s take a closer look at how to calculate gross profit and its impact on financial reporting.

Gross profit formula

The gross profit formula calculates profit by subtracting the cost of goods sold from revenue:

Gross profit = (Revenue – Cost of goods sold)

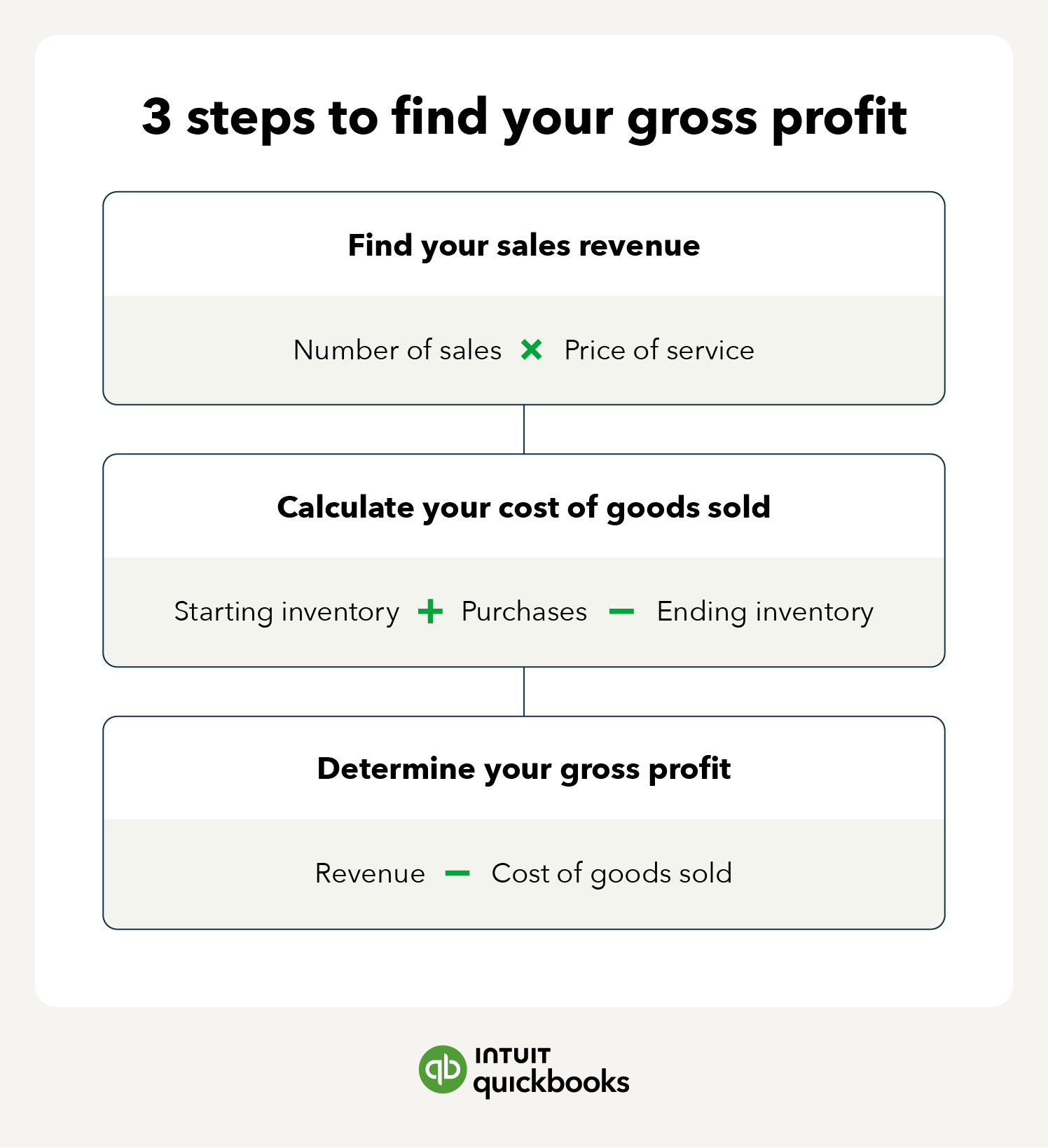

How to calculate gross profit

Calculating gross profit involves understanding two key figures: sales revenue and cost of goods sold (COGS). These usually come from your financial statements but you can also find them by diving into your earnings, administrative expenses, and business credit card transactions.

Step 1: Find your sales revenue

Sales revenue is the total income generated from selling your products or services. It’s important to note that sales revenue differs from your company’s profits. Profit is the income that is left over after you deduct your COGS. To find your sales revenue, either look at your financial statements or calculate all of your earnings for the term you’re looking at.

The revenue formula looks like:

Revenue = Number of sales x price of service

Step 2: Calculate your cost of goods sold

The cost of goods sold can be a bit more tricky. COGS represents the direct costs associated with producing the goods or services you sell. First, you need to break down all of your costs and determine which category they fall under. Those include:

-

- Direct vs. indirect costs: Direct costs (materials, labor) are directly related to producing a product or delivering a service. Indirect costs, on the other hand, (rent, utilities) cannot be traced to a specific product or service.

-

- Fixed vs. variable costs: Fixed costs remain constant (rent, salaries), while variable costs fluctuate with production volume (materials, labor).

-

- Inventoriable costs: Inventoriable costs are defined as all costs to prepare an inventory item for sale (raw materials, work in progress, finished goods).

Finding your cost of goods sold should look like this:

COGS = Beginning inventory + purchases +other costs – ending inventory

Step 3: Determine your gross profit

Lastly, it’s plug and play—simply take your sales revenue and subtract your cost of goods sold using the gross profit formula. Let’s look at an example.

Gross profit example

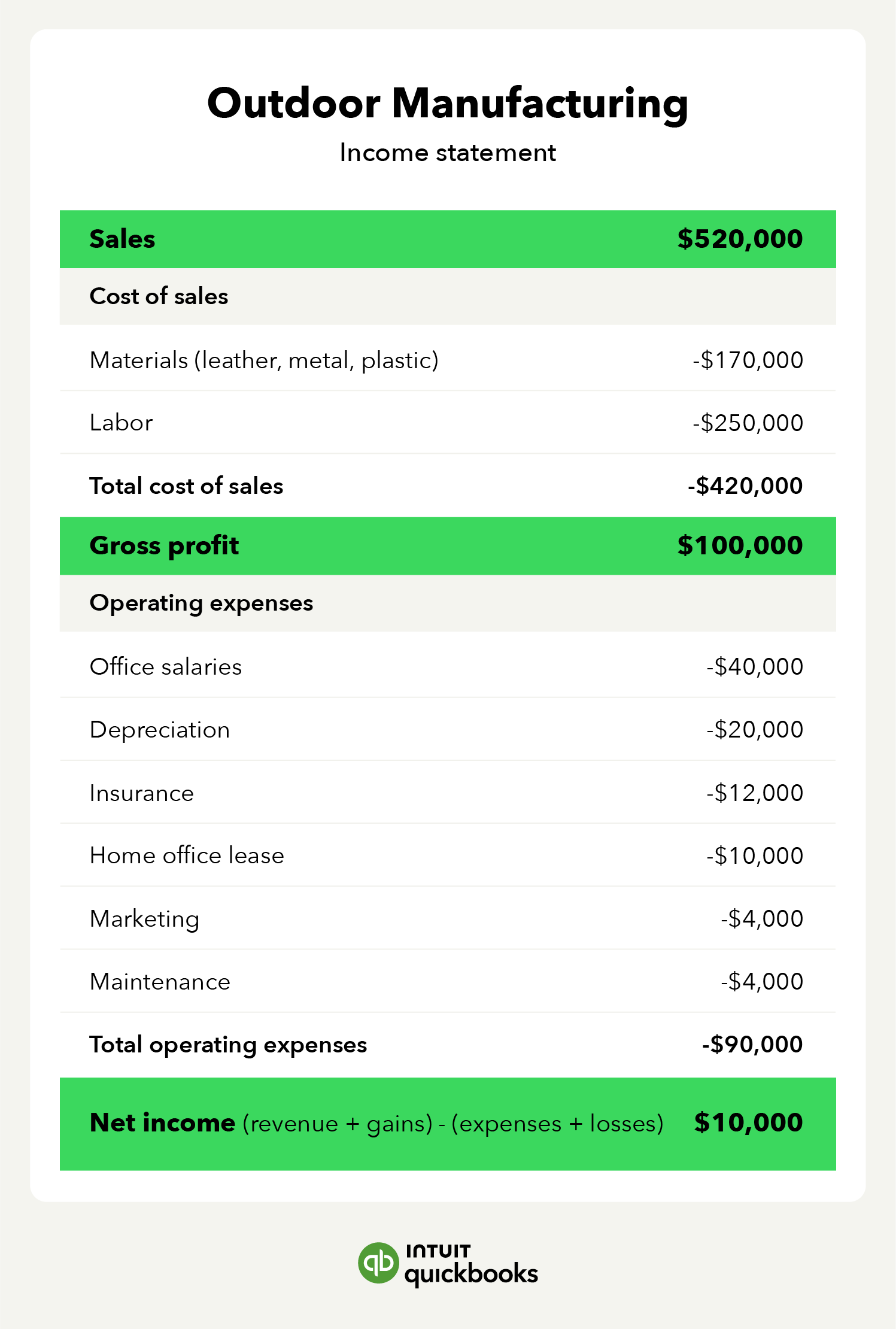

To understand the gross profit formula, meet Sally, the owner of Outdoor Manufacturing. Sally’s business manufactures hiking boots, and her firm just completed its first year of operations.

The sales component of the formula is straightforward (selling price multiplied by the number of boots sold). Outdoor sold $520,000 in boots this year (revenue). However, the firm’s cost of sales component is more complex. The cost of goods sold includes direct costs, like materials and labor used to make the boots, and indirect costs, like factory overhead, which adds up to $420,000 (COGS).

Understanding gross profit will help Sally assess the core profitability of the products after accounting for production costs. This is crucial for making pricing and production decisions.

Using the information in the income statement, we can calculate Outdoor Manufacturing’s gross profit:

$520,000 (Revenue) – $420,000 (COGS) = $100,000

Gross profit vs. net profit

If gross profit is the money left over after COGS you deduct, what exactly is net profit? And what’s the difference between gross profit vs. net income? Essentially, net profit (also known as net income) considers all associated expenses—think business expenses and taxes—whereas gross profit only accounts for COGS.

A firm can use the gross profit formula to assess its profitability. The caveat is that gross profit disregards some additional expenses the company incurs, like operating costs. Net profit fills in these gaps by accounting for all business expenses.

The net profit formula is:

Net profit = Total revenue – total expenses

Using the example above, the net profit for Outdoor Manufacturing is:

$10,000 = $520,000 – $510,000

Profit vs. profitability

Both profit and profitability aim to measure how much profit a company makes. The difference is that profitability is more of a relative measurement, typically expressed in a ratio, whereas profit is an absolute measurement, expressed in a dollar amount.

While you’ll always use the same formula to calculate gross profit, measuring profitability is more fluid, and you can express it in multiple ways.

Gross profit vs. gross margin

The difference between gross profit and gross margin has everything to do with how profits and margins are expressed. While gross margin is expressed as a percentage, gross profit is stated as a dollar amount.

Gross margin is defined by this formula:

(Total revenue – COGS) / (Total revenue)

For example, the gross margin for Outdoor Manufacturing is:

19.2% = ($520,000 – $420,000) / ($520,000)

For every dollar of sales, Outdoor Manufacturing generates about 19 cents of gross margin. The gross profit formula helps you identify cost-saving opportunities on a per-product basis.

Gross profit vs. operating profit

Operating profit is another term that seems similar to gross profit, but they measure very different things. Gross profit measures a business’s profit after deducting COGS, whereas operating profit measures a business’s profit after deducting all operating expenses.

Operating profit covers all essential costs associated with day-to-day business operations, which include things like labor and internal tools.

Businesses typically analyze their supply chain profits using gross profit, while operating profit is used to measure the company’s overall operations efficiency. Because operating profit uses gross profit to calculate profitability, it’s measured after gross profit is determined.

The operating profit formula is:

Operating profit = Gross profit – Operating expenses

For example, the operating profit for Outdoor Manufacturing is:

$10,000 = $100,000 – $90,000

Run your business with confidence

Get help and guidance when you need it from real bookkeeping experts at Eric Buchholz Bookkeeping… Get Started right HERE!

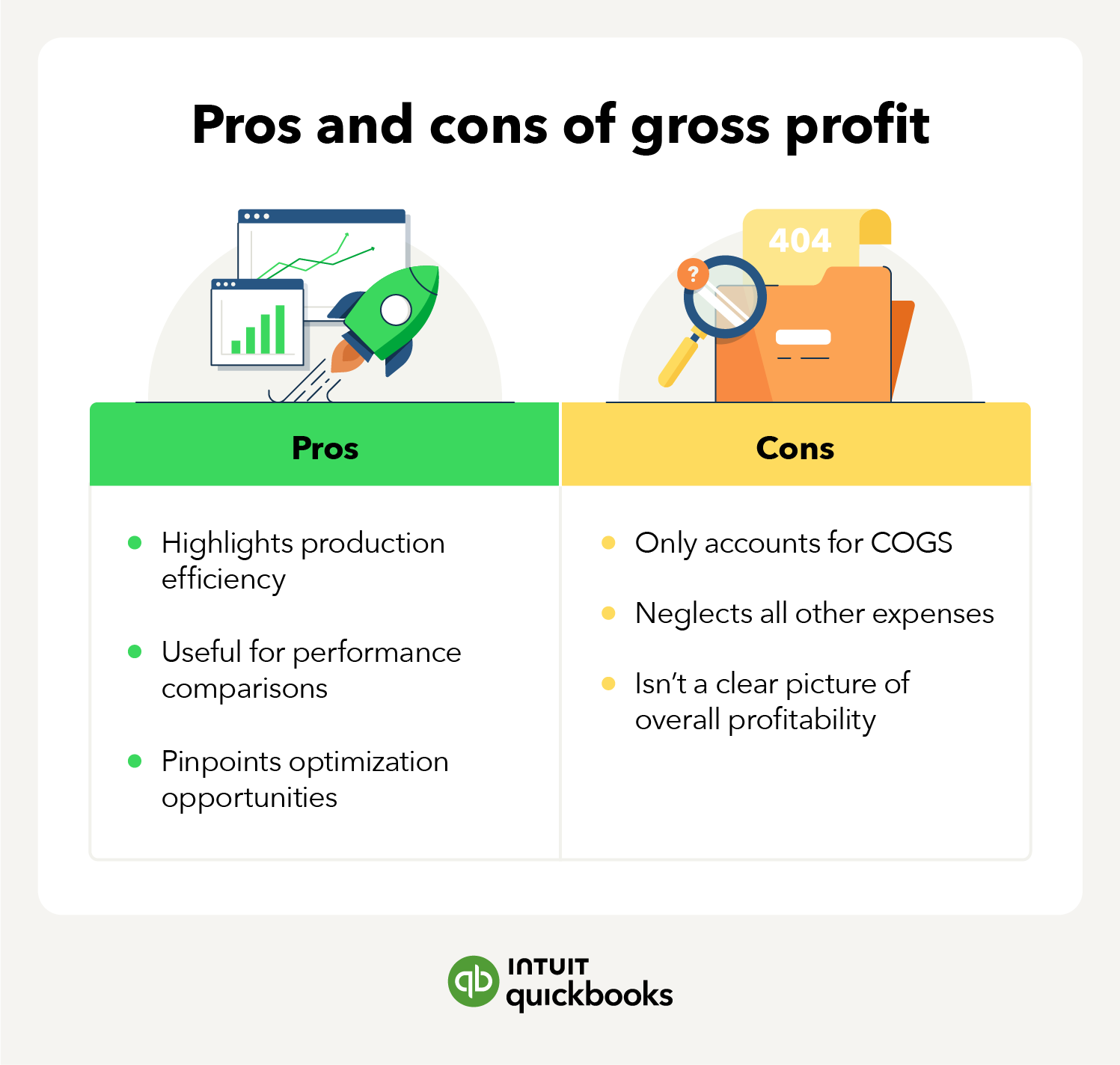

Advantages and limitations of gross profit

Gross profit provides a clear picture of a company’s profitability from its products or services. Since gross profit only encompasses profit as a percentage of sales revenue, it’s the perfect factor when comparing companies. For example, analyzing gross profit can help identify areas for cost control, such as negotiating better deals with suppliers or optimizing production processes.

That said, gross profit is only one piece of the puzzle. It can be limiting since it only takes into account the profitability from COGS and not additional relevant data, such as rising material costs or labor shortages. For example, a low gross profit in a service company with minimal cost of goods sold might not necessarily indicate poor performance.

Instead, companies may need to analyze trends in gross profit over time and consider other profitability metrics, such as operating profit and net profit, to assess their overall financial health.

How to increase gross profit

A company’s gross profit is not just for reflecting on the profitability of a company—you can also use it to increase profits. To improve gross profit, focus on the components of the formula, including total revenue and the cost of goods and labor.

-

- Increase revenue: Businesses can increase revenue by raising prices, but price increases can be difficult in industries that face a high level of competition. The most effective way to bolster revenue is to increase sales to your existing customer base. You can also increase revenue by improving your marketing outcomes. Use promotions, rewards, and testimonials to promote your products, and survey your customers to find out what products they want.

-

- Reduce material costs: You can reduce material costs by negotiating a lower price with your suppliers. If you’re a large customer who buys materials every month, you may be able to negotiate a lower price based on your purchase volume. The material costs you incur are driven by cost and usage. Analyze your production and take steps to avoid wasting material.

-

- Decrease labor costs: The hourly rate you pay is closely tied to current economic conditions and the rate of unemployment. If the economy is growing, you may need to pay a higher hourly rate of pay to hire qualified workers. The opposite is true in a slowing economy. Invest in training so that employees can work efficiently. Well-trained workers can get more done in less time, and they make fewer mistakes.

Spend more time growing your business

When you build a budget, knowing what gross profit is can reduce costs and increase revenue in the planning process. But finding gross profit can be tricky, especially when you’re strapped for time. That’s where accounting software comes in.

Ready to get started?

Take routine bookkeeping off your never-ending to-do list with the help of a certified professional. At Eric Buchholz Bookkeeping, we can help ensure that your business’s books close every month, and you’re primed for tax season. Our expert certified QuickBooks ProAdvisors have over 25 years of experience working with small business bookkeeping across various industries.

Whether you’re trying to learn how to calculate your cost of goods sold, or how to determine your gross profit, Eric Buchholz Bookkeeping can guide you down the right path. Schedule your FREE phone consultation today!… Simply CLICK HERE.

Gross profit - FAQ's

What does gross profit measure?

What is a good gross profit?

What is gross revenue?

What is the difference between gross sales vs. gross profit?