As a small business owner, knowing which accounting practices you should use can be confusing. However, you must remember the fundamental accounting principles for your business’s finances. One crucial fundamental principle is double-entry bookkeeping.

Double-entry bookkeeping is an important concept that drives every accounting transaction in a company’s financial reporting. Business owners must understand this concept to manage their accounting process and to analyze financial results. Use this guide to learn about the double-entry bookkeeping system and how to post accounting transactions correctly.

While bookkeeping refers to the day-to-day journal entries of a business, and accounting uses the information in those journals to create reports, when used in relation to the double-entry system, it’s often called either double-entry bookkeeping, or double-entry accounting.

What is double-entry bookkeeping?

Double-entry accounting is the standardized method of recording every financial transaction in two different accounts. For each credit entered into a ledger there must also be a corresponding (and equal) debit.

The term “bookkeeping” refers to a business’s recordkeeping process. A bookkeeper reviews source documents—like receipts, invoices, and bank statements—and uses those documents to post accounting transactions. If a business ships a product to a customer, for example, the bookkeeper will use the customer invoice to record revenue for the sale and to post an accounts receivable entry for the amount owed.

When entering business transactions into books, accountants need to ensure they link and source the entry. Linking each accounting entry to a source document is essential because the process helps the business owner justify each transaction.

Bookkeeping supports every other accounting process, including the production of financial statements and the generation of management reports for company decision-making.

Why is double-entry bookkeeping important?

Double-entry bookkeeping is the standard method of accounting, and using it provides a number of important benefits:

-

- Provides a clear view of your company’s financial health

-

- Allows you to spot and resolve errors quickly

-

- Helps identify profitable and unprofitable aspects of business

-

- Snapshot of your business that banks and investors can easily understand

Benefits of double-entry bookkeeping

Here’s why embracing double-entry bookkeeping can be a game-changer for your business:

More accurate records

Since you’re recording every transaction twice, it’s easier to catch mistakes or omissions. The total debits should always equal the total credits, so any errors will stand out right away.

Offers greater insights

With double-entry bookkeeping, you’re tracking income and expenses in great detail, so you can clearly see where money is coming in and out of your business. For example, you may notice that certain expenses — e.g., inventory or utilities — are higher than expected. From there, you can take measures to reduce these costs, like negotiating better supplier rates or exploring energy-efficient solutions.

Simplifies tax preparation

When it comes time to file your taxes, it won’t be a headache. Double-entry bookkeeping lends itself to a more organized accounting system. You’ll have a clear record of your transactions throughout the year, making it simpler to calculate your taxable income and take advantage of tax deductions like travel and home office expenses. Plus, if the IRS conducts an audit, you’ll have everything you need to back up your numbers.

Fraud detection

This double-entry system also means there’s less chance of fraudulent activity slipping through the cracks. For instance, if someone tries to inflate expenses or hide revenue, the imbalance in the records will flag the issue. This approach gives you the opportunity to investigate the situation and resolve it quickly before it becomes a bigger problem.

Limitations of double-entry bookkeeping

While double-entry bookkeeping offers several advantages, it also comes with certain limitations, including:

Complexity and learning curve

If you’re new to the business world, jumping into double-entry bookkeeping can feel a bit overwhelming. You’ll need to know how to categorize transactions as either debits or credits and understand how different accounts (assets, liabilities, and equity) interact with each other. For example, when you purchase inventory, you’ll record it as an increase in assets while decreasing cash or increasing accounts payable (liabilities).

Time-consuming

Recording each transaction twice can be time-consuming, especially if you’re managing them manually. For small businesses and startups with limited resources, this extra time could take away from other important tasks, like serving customers or planning marketing campaigns.

Higher costs

Since doubt-entry bookkeeping can be complex, you may need to invest in training courses, accounting software, or hiring a professional to manage your books. As a small business or startup, this could raise your costs, but in the long run, it’ll be beneficial because it provides you with more accurate financial records.

Potential for human error

While double-entry bookkeeping helps detect errors, it doesn’t eliminate them entirely. Mistakes can still happen, especially if you’re entering transactions manually. For example, you might accidentally record the wrong amount, misclassify a transaction, or forget to enter both sides of an entry. These little errors can lead to time-consuming corrections in the future.

Who is double-entry bookkeeping for?

Unless you have a very small operation with low transaction volumes, double-entry bookkeeping works best for most businesses. In fact, this system is the only bookkeeping method that complies with Generally Accepted Accounting Principles (GAAP) set by the Financial Accounting Standard Board (FASB). If your company is public in the U.S., you must use double-entry bookkeeping and follow any other accounting rules laid out in GAAP.

Even if you’re not running a public company, double-entry bookkeeping is still beneficial. For one, if your business is looking for a loan, investors and lenders want to see detailed, accurate financial information. With the double-entry system, you can give them a clear picture of your assets, liabilities, and cash flow and better your chances of securing a loan.

For businesses with inventory, such as retailers or manufacturers, you can use double-entry bookkeeping to help track your inventory levels and manage the costs of goods sold. Even nonprofits can use double-entry bookkeeping. While you may not deal with things like inventory or product sales, you still need to track donations, grants, and expenses so you can generate reports to keep your stakeholders in the loop.

All in all, despite the initial learning curve, double-entry bookkeeping is a powerful tool that gives you a more accurate, detailed view of your finances. When you first start your business, you can get your feet wet with a more simplified system like single-entry bookkeeping. But as your operation grows, you’ll want to transition to double-entry to handle more complex transactions.

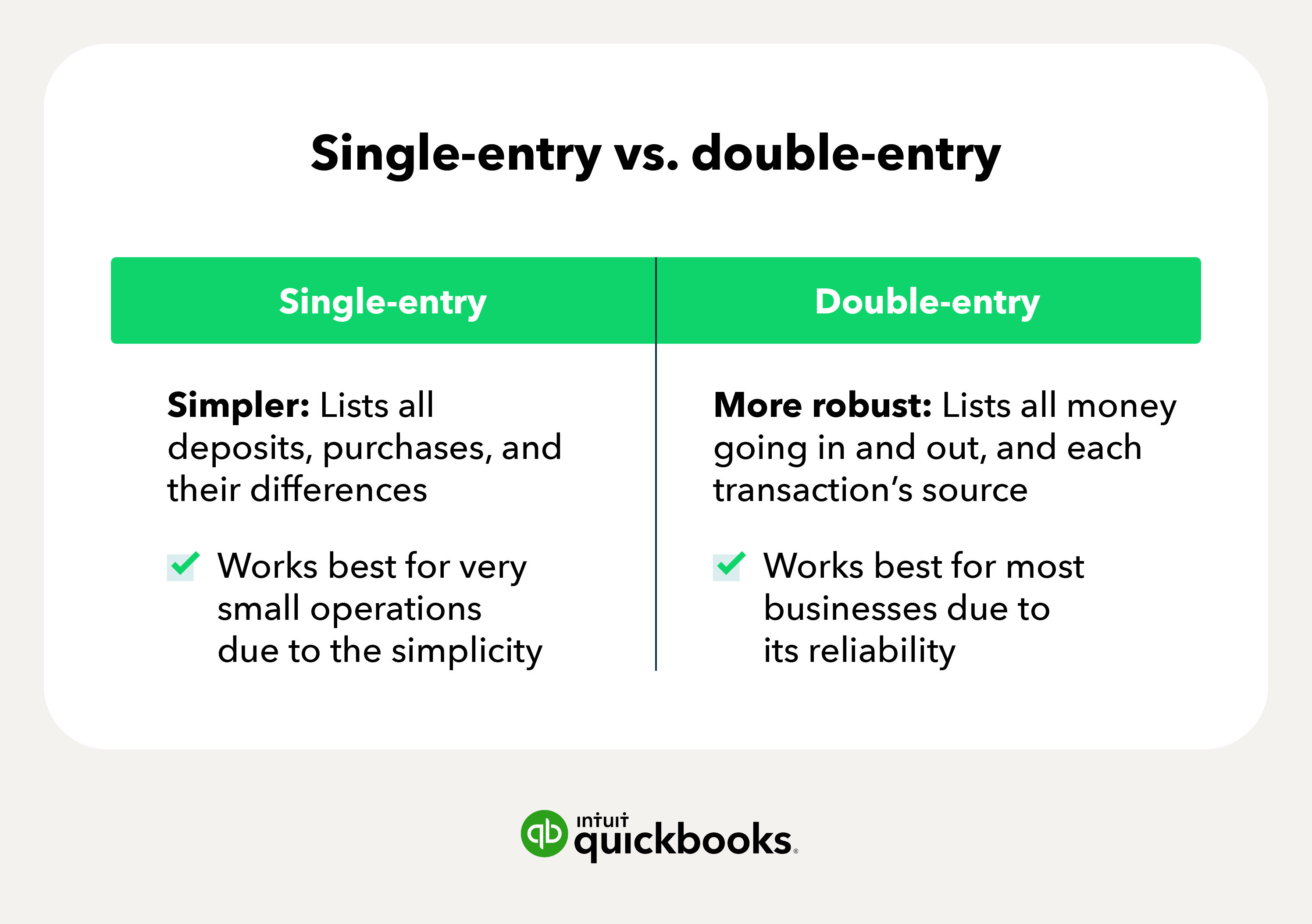

How does single-entry bookkeeping differ from double-entry?

Single-entry bookkeeping is much like the running total of a checking account. You see a list of deposits, a list of purchases, and the difference between the two equals the cash on hand. For very small businesses with only a handful of transactions, single-entry bookkeeping can be sufficient for their accounting needs.

Double-entry bookkeeping shows all of the money coming in, money going out, and, most importantly, the sources of each transaction. If you see in the debit column that you took in $1,000 in sales, but you only have $500 in cash, double-entry bookkeeping will show you that you also received $500 from some other source, like credit card transactions.

Double-entry bookkeeping creates a “mirror image” of both sides of each financial transaction, allowing you to compare one column of credits against a column of debits and easily spot any discrepancies. Single-entry bookkeeping doesn’t allow for this type of verification. Although single-entry bookkeeping is simpler, it’s not as reliable as double-entry and isn’t a suitable accounting method for medium to large businesses.

What are the principles of double-entry bookkeeping?

-

- For every business transaction, both a debit and a credit entry must be recorded.

-

- The debits will be listed in a column on the left-hand side of the ledger sheet, and the credits listed in a column on the right-hand side of the page.

-

- When totaled up, these columns of debits and credits will be equal to each other.

Common mistakes in double-entry accounting

Double-entry accounting is the foundation of bookkeeping and financial reporting, but even experienced accountants and bookkeepers can make errors. Here are some of the common ones:

Transposition mistakes

These errors occur when digits are reversed, like entering $95 instead of $59, leading to account imbalances.

Omissions

An omission mistake is when a transaction is entirely left out, resulting in inaccurate financial statements.

Commission error

A transaction recorded in the wrong account, such as mistaking an expense for an asset, is called a commission error. These mistakes can distort financial ratios.

Misapplied principles

Mistakes arise when accounting principles are misapplied. For example, classifying a long-term liability as short-term can impact liquidity ratios.

Incorrect original entries

These errors occur when a transaction is initially recorded with the wrong amount or date, affecting the entire system.

Compensating errors

Compensating errors are multiple mistakes that balance each other out, giving a false sense of accuracy.

Duplicating transitions

Recording a transaction more than once inflates income or expenses and leads to incorrect financial reports.

Reversing entries

Entry reversal errors occur when debits and credits are flipped during recording, leading to inaccurate account balances and financial reports.

How to record a journal entry

Accountants will use the general journal as part of their recordkeeping system. The general journal is an initial record where accountants log basic information about a transaction, such as when and where it occurred, along with the total amount. Each of these recorded transactions are referred to as a journal entry. Here’s a breakdown of the process:

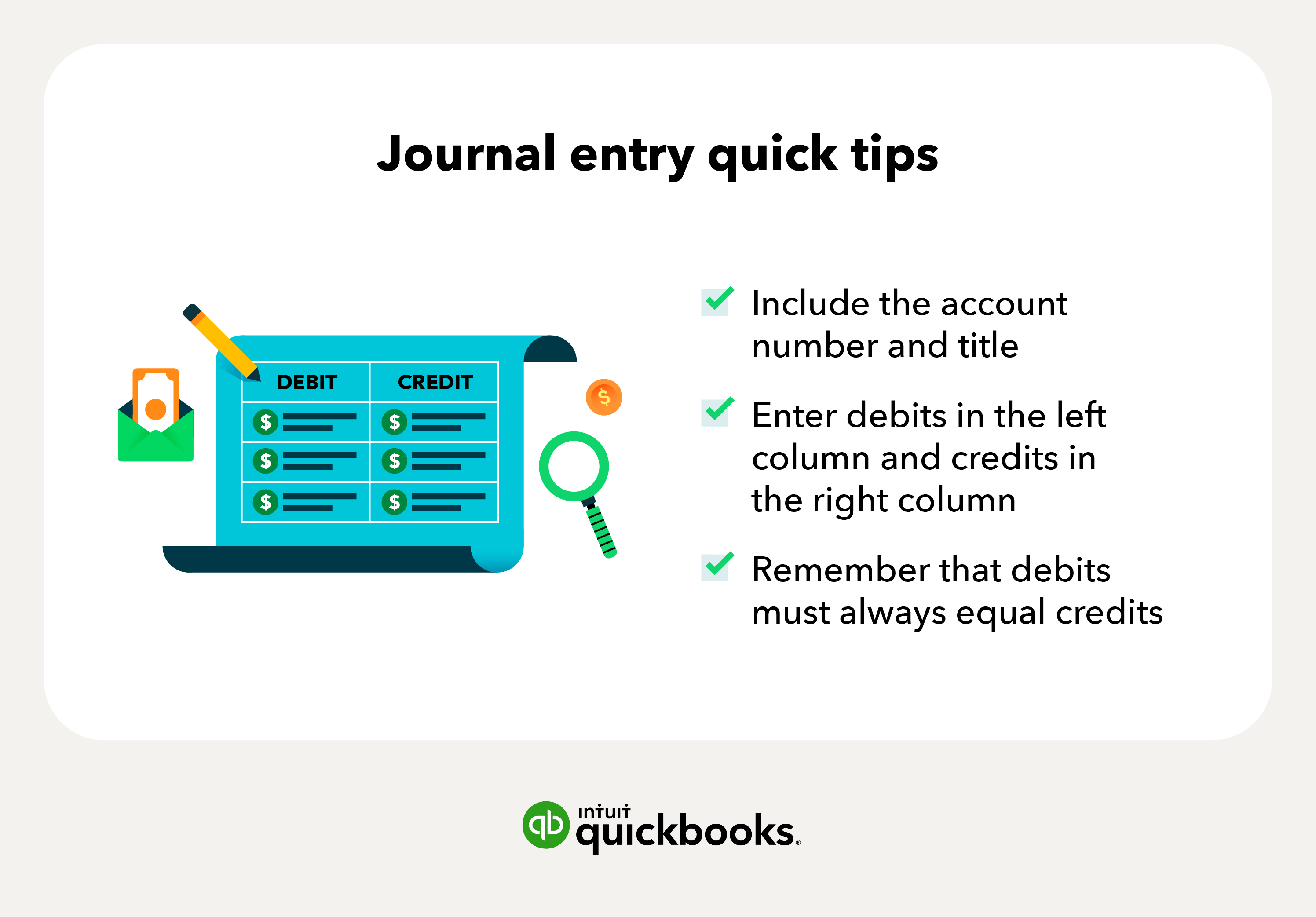

Step 1: Record transactions in the general journal

A journal entry records debits and credits to post an accounting entry, along with a description of the transaction. You post journal entries into columns, and the left-hand column lists the account number and account title. To the right, you have two columns: one for debits and one for credits. A detailed explanation of the transaction is posted below each journal entry.

Step 2: Be sure to apply the rules of double-entry bookkeeping

The double-entry bookkeeping system uses debits and credits to post accounting transactions and keep the balance sheet equation equal. This method is often misunderstood, so it’s essential to understand these ground rules:

-

- Debits are on the left side of the accounting entry, and credits are on the right side.

-

- Most asset and expense accounts are increased with a debit entry, while most liability and revenue accounts are increased with a credit entry.

-

- The total dollar amount of debits must always equal the total dollar amount of credits. If you attempt to post an entry into accounting software that is not balanced, you’ll get an error message.

What causes confusion is the difference between the balance sheet equation and the fact that debits must equal credits. Keep in mind that every account, whether it’s an asset, liability, or equity, will have both debit and credit entries.

Step 3: Maintain balance in the general journal and balance sheet

When using the double-entry accounting system, two things must always be balanced. The general ledger, which tracks debit and credit accounts, must always be balanced. Additionally, the balance sheet, where assets minus liabilities equals equity, must also be balanced. The examples below will clarify the rules for double-entry bookkeeping.

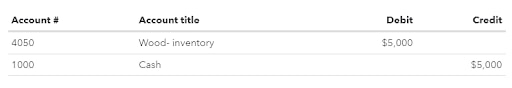

A simple double-entry bookkeeping example

Assume that a furniture company purchases $5,000 of wood for inventory and pays cash for the purchase. Here is the journal entry, with account numbers included:

This is a simple journal entry because the entry posts one debit and one credit entry. The company should debit $5,000 from the wood – inventory account and credit $5,000 to the cash account.

Both of these accounts are asset accounts, and the balance sheet equation remains in balance:

The debit entry increases the wood account and cash decreases with a credit so that the total change in assets equals zero. Liabilities remain unchanged at $0, and equity remains unchanged at $0.

A more complex double-entry bookkeeping example

A complex journal entry means that the entry may have multiple debit entries, more than one credit entry, or both. Assume, for instance, that a furniture company purchases a $30,000 machine by paying $5,000 in cash and borrowing $25,000. Here is the complex journal entry:

In this example, the company would debit $30,000 for the machine, credit $5,000 in the cash account, and credit $25,000 in a bank loan accounts payable account. The total debit balance of $30,000 matches the total credit balance of $30,000.

This is a complex journal entry because the entry posts two credit entries. However, you can see that the balance sheet equation remains equal:

The company gains $30,000 in assets from the machine but loses $5,000 in assets from cash. This means assets are now $25,000. Liabilities are also worth $25,000, which, in this case, comes in the form of a bank loan. So, $25,000 minus $25,000 equals $0. The balance sheet equation is correct.

Regulatory and compliance benefits of double-entry bookkeeping

Double-entry bookkeeping is beneficial not only for financial recordkeeping but also for meeting regulatory and compliance requirements.

Helps ensure reporting meets industry standards

Double-entry bookkeeping ensures that every transaction is recorded twice, as a debit and a credit. This system of checks and balances supports built-in accuracy, which is essential for generating financial statements that comply with accounting standards like Generally Accepted Accounting Principles (GAAP).

Creates audit trail

The double-entry system creates a clear audit trail, making it easier to trace the origin of any transaction. This transparency is vital for internal audits, tax audits, and demonstrating financial regulatory compliance.

Deters fraud

Double-entry bookkeeping makes it more difficult to manipulate financial records or conceal fraudulent activity by requiring every transaction to have a corresponding debit and credit. This helps deter fraud and provides a safeguard against financial irregularities.

Assists with tax compliance

Many tax authorities require businesses to use double-entry bookkeeping for tax reporting purposes. The records generated by this system are reliable, making it easier to comply with tax laws and regulations. Fewer error risks mean less risk of penalties.

Supports legal requirements

Double-entry bookkeeping is often a legal requirement for businesses, especially those that are incorporated or have a certain level of revenue. Maintaining accurate and compliant financial records is essential for meeting legal obligations and avoiding potential legal issues.

Run your business with confidence

If you find the thought of regular bookkeeping sessions tedious or simply don’t have the time to dedicate to it, then consider hiring a professional bookkeeper. A qualified bookkeeper can remove this burden, ensuring your finances are meticulously maintained. They can also offer valuable insights and guidance to help you make informed financial decisions for your business.

Verify your books with a trial balance

At any point in time, an accountant can produce a trial balance, which is a listing of each account and its current balance. The total debits and credits on the trial balance will be equal to one another. Accountants frequently review the trial balance to verify that they posted journal entries correctly, as well as to correct any errors.

At the end of each month and year, accountants post adjusting entries to the trial balance and use the adjusted trial balance to generate financial statements. Accounting software provides controls to ensure your trial balance is accurate. The software will ensure that the total dollar amount of debits equals the credit balance and that each account balance is in your trial balance report.

Using double-entry accounting to ensure accurate recordkeeping

As you can see, the entire accounting process starts with double-entry bookkeeping. Whether you do your own bookkeeping with small business bookkeeping software or hire a bookkeeper, understanding this critical accounting concept is essential for the success of your small business.

If you’ve previously used a single-entry system, you may be wondering how to go about switching to a double-entry system. Most modern accounting software has double-entry concepts already built in.

Business owners who have previously operated on a single-entry system will want to make the switch to a double-entry system as soon as possible. As your business grows, so too will the complexity of your finances. Implementing a double-entry system of accounting will allow you to put your financial statements to better use so that you can measure your financial health and spot errors quickly.

Can accounting software make a difference?

For a sole proprietorship, single-entry accounting can be sufficient, but if you expect your business to keep growing, it’s a good idea to master double-entry accounting now. Double-entry accounting will allow you to have a deeper understanding of your company’s financial health, quickly catch accounting mistakes, and share a snapshot of your business with investors. With the help of accounting software, double-entry accounting becomes even simpler.

Ready to get started?

Take routine bookkeeping off your never-ending to-do list with the help of a certified professional. At Eric Buchholz Bookkeeping, we can help ensure that your business’s books close every month, and you’re primed for tax season. Our expert certified QuickBooks ProAdvisors have over 25 years of experience working with small business bookkeeping across various industries.

Whether you’re trying to grasp the double-entry bookkeeping method, learn how to read a cash flow statement, or create a chart of accounts, Eric Buchholz Bookkeeping can guide you down the right path. Schedule your FREE phone consultation today!… Simply CLICK HERE.

Double-entry bookkeeping in accounting – FAQ’s

When a company is using double-entry accounting, what elements of a given ledger must be equal?

In double-entry accounting, what's the difference between debits and credits?

What is the basic rule of double-entry bookkeeping?

Is double-entry bookkeeping hard?

Originally published by Ken Boyd on December 3, 2024