What is a bookkeeper?

A bookkeeper is a professional who helps businesses and other organizations keep their finances in order. They manage general accounting ledgers, record journal entries, and generate financial statements.

Bookkeeping is vital to your business finances, but what exactly is in a bookkeeper job description?

Broadly, a bookkeeper’s job is to manage the books by keeping track of day-to-day business finances. Bookkeeping professionals have their own expertise based on the types of businesses and industries they serve.

Let’s explore what bookkeepers do, some of the benefits of bookkeeping, and your options for using a bookkeeper.

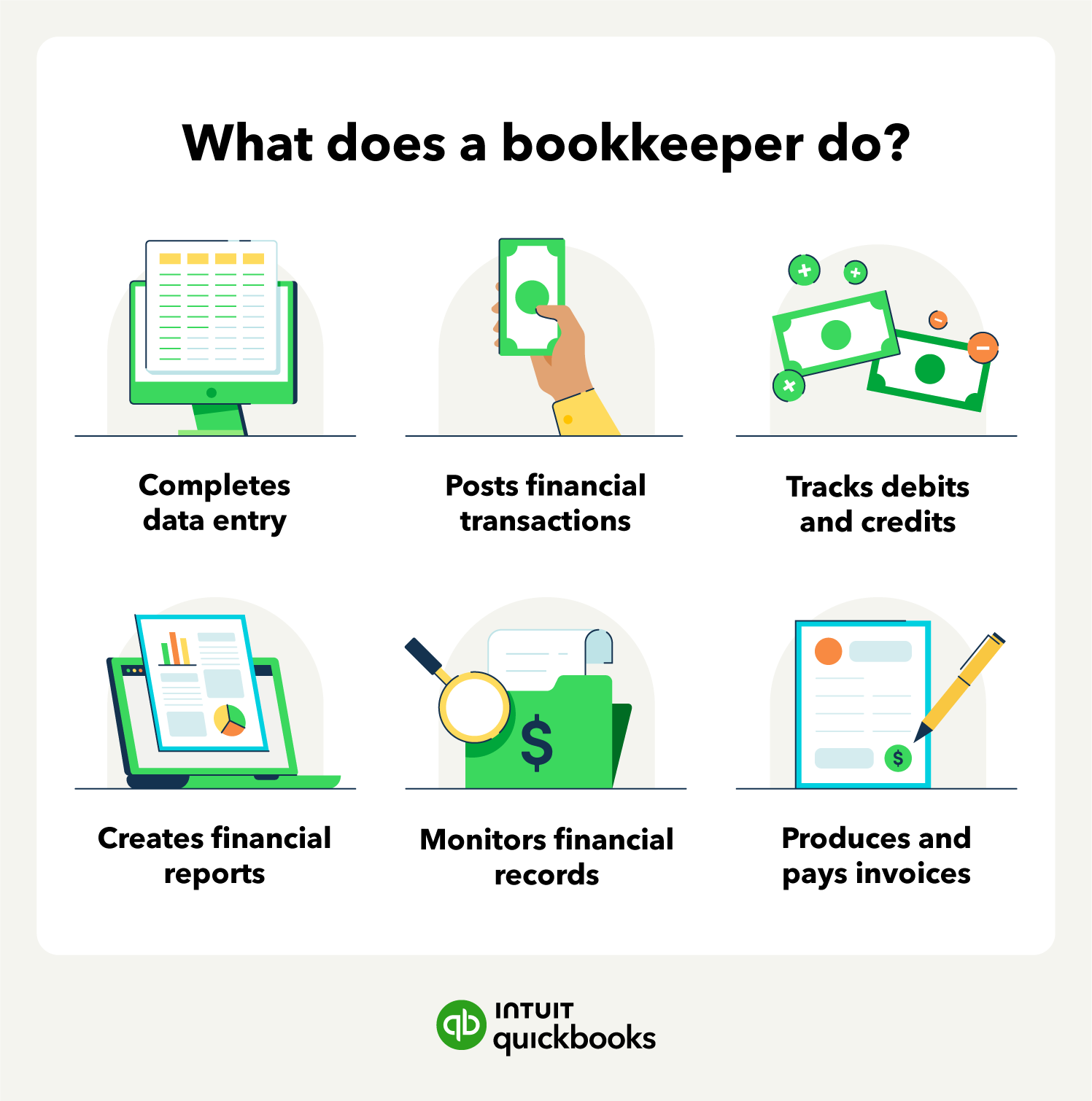

Common bookkeeper duties

Bookkeepers help businesses keep their finances on track by keeping tabs on different accounts, transactions, and reports. They collect, organize, and store the business’s financial records, including cash flow statements, reconciliation statements, and profit and loss statements.

Bookkeepers also make it possible for business owners and accountants to build budgets, identify trends, and plan for the future.

Some typical bookkeeping responsibilities include:

- Complete data entry and collect transaction details for incoming and outgoing bank accounts.

- Use bookkeeping software, spreadsheets, and other databases to post up-to-date financial transactions.

- Generate financial reports, such as balance sheets and income statements.

- Maintain and monitor financial records for accuracy.

- Reconcile or report any discrepancies in financial reports.

- Produce or pay invoices for credit card bills or inventory orders.

- Complete payroll.

You might need only some or all of these services that can be part of the job of a bookkeeper. How your business operates is unique, and your bookkeeping follows suit.

Types of bookkeeping

There are different types of bookkeeping services available, depending on the time and money investment you want to make. If you’re thinking about hiring a bookkeeper or want to clean up your business books, there are different bookkeeping types that can suit your needs.

Bookkeeping options include:

- DIY: If you know numbers and spreadsheets, doing bookkeeping yourself is an option. However, it’s important to consider how time-consuming the tasks might be, and how they might cut into your other business responsibilities.

- Bookkeeping software: For many business owners, intuitive business software like QuickBooks empowers them to take the lead on their bookkeeping efforts.

- Remote or virtual bookkeeper: A remote or virtual bookkeeper works entirely online, which can be convenient and cost-effective. If you’re a QuickBooks Online user, you can connect with a certified QuickBooks ProAdvisor at Eric Buchholz Bookkeeping to help bring your financials up to date and manage your books going forward.*

- Firm: A bookkeeping and accounting firm can provide a variety of business and financial services, including bookkeeping, accounting, tax filing, payroll services, and consulting. Often, bookkeepers and certified public accountants (CPAs) work under the same roof.

- In-house professional: You could hire a full-time or part-time employee to do your bookkeeping. This tends to be one of the more expensive avenues for small business owners.

Run your business with confidence

Get help and guidance when you need it from real bookkeeping experts at Eric Buchholz Bookkeeping… Get Started right HERE!

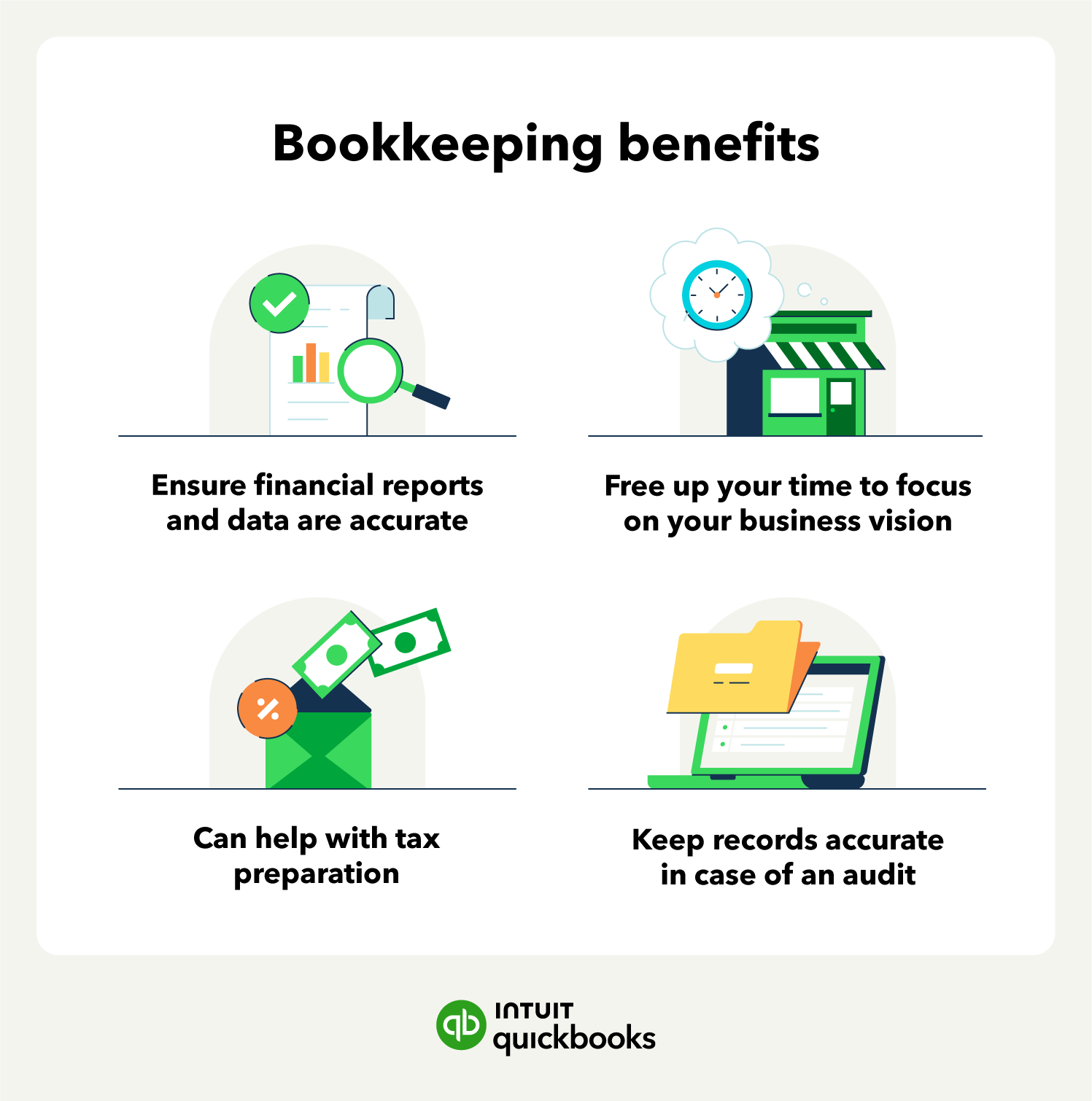

Benefits of having a bookkeeper

You know what a bookkeeper does and what their day-to-day responsibilities look like. But how do these job duties translate as benefits for your business? A bookkeeper can help ensure your business finances are organized and lets you focus on running and growing your small business.

Benefits of bookkeeping include:

- Time to focus on your business: Bookkeepers free up time in your schedule for things like building your vision, polishing workflows, and boosting your bottom line.

- Accurate financial records: Hiring a professional bookkeeper minimizes the margin of error. Professional bookkeepers can help you generate accurate financial reports and data.

- Tax preparation: Tidy books mean less cleanup to do when taxes are due. Some bookkeepers offer tax preparation, which can be especially valuable when breaking down complex small business tax codes.

- Keep historical records: If the IRS or another entity audits your business, having solid bookkeeping records on hand is a huge plus. Often, the auditing process is a simple review of your records. Things can become more challenging than necessary if your bookkeeping records are out of order.

Bookkeeper vs accountant: What’s the difference?

There are key differences between bookkeepers and accountants that you want to know before hiring a financial professional.

Bookkeepers help business owners manage their finances by documenting transactions, paying and issuing invoices, generating reports, and recording accurate financial data. Bookkeepers can also deliver reports on your business’s financial standing. But what do all of these figures mean, and where do you go from there? That’s where an accountant comes in.

Accountants use the records a bookkeeper provides and their own expertise to help build budgets, assess finances, and make business decisions. Additionally, an accountant may oversee a bookkeeper’s work. Accountants have higher education requirements and may have training in bookkeeping roles.

When comparing accountants and bookkeepers, know that an accountant may also be a bookkeeper. However, entry-level bookkeepers are not accountants.

How to choose the right bookkeeper?

If you’re considering hiring a bookkeeper, a few things can play a part in your decision. To help you choose the best option for your business:

- Understand your business needs: Identify your business’s specific bookkeeping and accounting needs, whether that is basic data entry, financial analysis, or help with payroll and tax preparation. Consider which bookkeeping tasks you can and want to do yourself with bookkeeping software.

- Look at qualifications and experience: Search for bookkeepers with relevant qualifications and experience, such as a software certification and the types of businesses they’ve worked with.

- Take a look at your budget: Set a budget for bookkeeping ahead of time to help you find the right bookkeeping service. Request a clear breakdown of their bookkeeping fees and services.

- Identify communication preferences: Understand how often you’ll need to connect with your bookkeeper and how easily you can discuss financial matters with them.

Save time with verified expertise for your books

Bookkeepers offer support to several organizations, including small businesses, nonprofits, and corporations. They are vital to managing a business’s finances by documenting transactions, generating reports, and assisting with accounting efforts.

When selecting a bookkeeping style, business owners have several options. Looking for bookkeeping support? Learn how Eric Buchholz Bookkeeping can help you streamline your bookkeeping and free up time spent on finances.

Ready to get started?

Take routine bookkeeping off your never-ending to-do list with the help of a certified professional. At Eric Buchholz Bookkeeping, we can help ensure that your business’s books close every month, and you’re primed for tax season. Our expert certified QuickBooks ProAdvisors have over 25 years of experience working with small business bookkeeping across various industries.

Whether you’re trying to learn the difference between a bookkeeper & an accountant, or the benefits of having a certified bookkeeper in your corner, Eric Buchholz Bookkeeping can guide you down the right path. Schedule your FREE phone consultation today!… Simply CLICK HERE.