Filing business taxes can be intimidating. You might have questions like: “Am I using the correct IRS forms?” “How do I prepare my financial statements for tax season?” or “What deductions can I take?” You aren’t alone.

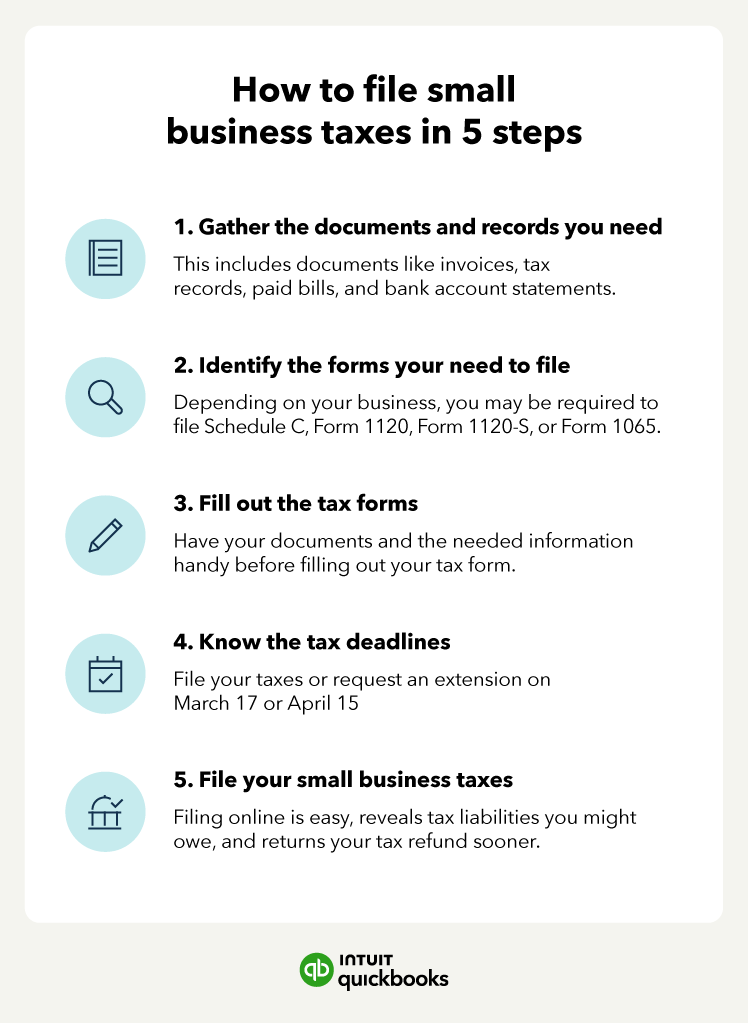

1. Gather your records for tax filing

At the most basic level, you need to file your tax return each year through the IRS to figure out your tax liability. As a business, you might have to pay taxes that include:

- Estimated tax: Quarterly federal and state tax payments made throughout the year for income that isn’t subject to tax withholding.

- Self-employment tax: Social Security and Medicare taxes for independent contractors and self-employed individuals.

- Sales tax: Taxes collected from taxable goods and services.

- Property tax: Taxes paid on the value of a business property.

- Excise tax: Taxes on specific goods or services.

- Employment taxes: Social Security, Medicare, federal income tax withholding, and Federal Unemployment Tax Act (FUTA) taxes.

For all these taxes, detailed records of business expenses you pay throughout the year can help lower your taxable income. You’ll need to get your company records together to report your business income and qualified business expenses.

Gather supporting documents for payroll, sales, purchases, and other qualified business expenses.

Some of the small business documents you should gather when preparing your taxes include:

- Invoices

- Paid and outstanding bills

- Canceled checks

- Deposit slips

- Sales slips

- Cash register tapes

- Credit card statements

- Bank account statements

- Employment tax records

- Year-end payroll reports

- Receipts for purchases of supplies and equipment

- Travel expenses

- Home office expenses (if you work from home)

- Depreciation schedules for assets you purchased for your business

Using tax preparation or financial software to track expenses and transactions throughout the year is often easier than trying to gather all the info right before your due date.

2. Know what IRS forms you need to file

The types of IRS forms you’ll need to fill out to file small business taxes depend on your business structure.

Here are the small business tax forms you might need to file according to your business structure:

- Sole proprietorship: If you’re a sole proprietor running an online e-commerce shop, for example, use a Schedule C IRS file form. Individuals need to attach their Schedule C to their personal tax returns.

- Partnerships: Partnerships or multimember LLCs file their business tax returns using Form 1065. Partners and the partnership need to report business activity to the IRS. A partnership sends Schedule K-1 out to partners.

- S corporations: If your business uses an S-corp structure, you’ll file Form 1120-S. This is often a good choice for small businesses due to potential tax advantages. A small marketing agency structured as an S-corp would use this form.

- C corporations: If you’ve incorporated your business as a C-corp, you’ll use Form 1120 to report your company’s income and expenses. This is a separate tax return from your personal taxes. While this is generally for larger businesses, it may still apply to growing startups.

- Limited liability companies (LLCs): LLCs use various forms, conditional on how the business elects to be taxed. Typically, most multimember LLCs default to be treated as a partnership, meaning they’d use Form 1065. If the LLC is a single-member LLC, then the entity is taxed the same as a sole proprietorship.

3. Fill out your small business tax forms

When filling out your small business tax forms, carefully follow each step and provide accurate information.

Here are some tips to fill out your forms:

- Read the instructions carefully: The IRS provides detailed instructions for each form. Take the time to read them carefully before you start filling out your return.

- Use tax software: Tax software can make it much easier to fill out your forms and avoid mistakes. Many software programs will even import data directly from your accounting software.

- Double-check your work: Before you file your return, double-check all of your entries to ensure their accuracy.

- Consider getting help: If you’re not comfortable filling out your forms alone, you can always hire a tax professional to help you.

Run your business with confidence

Get help and guidance when you need it from real bookkeeping experts at Eric Buchholz Bookkeeping… Get Started right HERE!

Schedule C

If you’re filing using Schedule C, the form is a bit less complex, as it is only two pages. Start by entering your basic business information, like your business name, address, and EIN (if you have one). Then, you’ll move on to reporting your income and expenses.

- Income: Report all the money your business earned during the year. Be sure to include all sources of income, such as sales and services.

- Expenses: Deduct your business expenses, like advertising costs, office supplies, and travel expenses. Remember to have your records handy to back up these deductions.

Once you’ve entered all your income and expenses, you’ll calculate your net profit or loss. This is the amount you’ll report on your personal income tax return (Form 1040).

Form 1065

Form 1065 is a bit more complex than Schedule C. You’ll need to provide information about your partnership or LLC, including the names and addresses of all partners or members. You’ll also need to report the partnership’s income and expenses.

Once you’ve completed Form 1065, you’ll need to prepare Schedule K-1 for each partner or member. This form shows their share of the partnership’s income or loss.

Form 1120 and Form 1120S

Form 1120 and Form 1120S are more extensive and might require a bit more time to fill out. Be prepared with all of the required information, and have your supporting documents handy before filling out your form.

4. Know the small business tax deadlines

During some tax years, the due date for sending in your personal income tax return or small business tax return falls on a holiday or a weekend. If that occurs, the new tax deadline is the next business day.

Here are the key tax filing dates and deadlines you’ll want to be aware of:

- March 17: For partnerships and multimember LLCs that file a Form 1065 with the federal government and give out a Schedule K-1 to partners, and S-corps filing Form 1120-S.

- April 15: For individuals, including sole proprietors or single-member LLCs filing Schedule C.

- April 15: Corporations with a fiscal year that ends on December 31, submitting Form 1120.

- 15th day of the 4th month after the fiscal year end: For businesses with a fiscal year that doesn’t end on December 31st.

File for a business tax extension if needed

Need to push back your deadline? You can file for a business tax extension to send your taxes in later with Form 7004. This form grants a six-month extension to file, though it doesn’t provide extra time to pay. If you use Schedule C to file your business taxes, you can request an extension to file your individual tax return with Form 4868. Get the extension filed before the deadline so you don’t have to pay penalties.

If you don’t file an extension and miss your tax filing deadline, you might face the Failure to File Penalty. The penalty is 5% of your unpaid taxes for each month or part of the month that your small business tax return is late.

5. File small business taxes

Now that you have everything in order, it’s time to file your small business taxes. You can do this one of two ways:

- E-filing: This is generally the preferred method. It’s faster, more secure, and reduces errors.

- Mailing a paper return: You can still mail your return to the IRS, but it takes longer to process and increases the chance of errors. If you choose this method, make sure to use certified mail with a return receipt for proof of delivery.

If you’re concerned about filing your taxes correctly, it’s worth enlisting the help of a licensed tax professional. With the help of a pro, you can ensure that you:

- Are compliant with tax laws.

- Make the appropriate tax payments.

- Understand your tax refund.

Note that e-filing is easier and faster than mailing, meaning you can get your tax refund faster too. The IRS offers many different filing options for small businesses to choose from.

Stay on top of small business tax payments

Many businesses have to make estimated tax payments throughout the year. You’re responsible for making estimated tax payments each quarter if:

- You’re a sole proprietor, partnership, or S corporation and expect to owe over $1,000 on your tax return, or

- You’re a corporation and expect to owe over $500 or more when the return is filed.

You can pay your estimated taxes on the IRS website, from your mobile device using the IRS2Go app, or by mailing in Form 1040-ES. Not making estimated tax payments or underpaying your taxes could result in a penalty from the IRS.

You still have to file an annual small business tax return and calculate your tax liability for the year, even after paying quarterly taxes. If you didn’t pay enough through your quarterly tax payments, you’ll be responsible for paying the remainder when you file your tax return.

Though you might still owe money at the end of the year, making quarterly small business tax payments can help lower your end-of-year tax bill.

Maximize your small business tax deductions

Small business owners can help lower their tax bills by maximizing deductions. Small businesses are allowed “ordinary and necessary” tax deductions that can help reduce taxable income.

A lower taxable income means you and your business might owe less money during the tax year. Some examples of small business tax deductions include business meals, travel expenses, home office costs, and vehicle use. It’s important to keep a detailed record of all your small business tax deductions.

Here are some tips for keeping records:

- Hold onto receipts from business expenses.

- Write out why each purchase counts as a business expense.

- Organize purchases by date.

- Note the amount paid for every business expense and payment method.

If the IRS audits a business’s write-offs, these records can help avoid penalties and fines.

Find peace of mind at tax time

Filing taxes can feel challenging to navigate on your own. Intuitive software with reports and organized data can give you peace of mind during tax season.

Get guidance on prepping your books for tax time with virtual bookkeeping services like Eric Buchholz Bookkeeping. An expert is by your side to answer questions.

Ready to get started?

Take routine bookkeeping off your never-ending to-do list with the help of a certified professional. At Eric Buchholz Bookkeeping, we can help ensure that your business’s books close every month, and you’re primed for tax season. Our expert certified QuickBooks ProAdvisors have over 25 years of experience working with small business bookkeeping across various industries.

Whether you’re learning how to maximize your small business tax deductions, or when the deadlines are for filing your taxes, Eric Buchholz Bookkeeping can guide you down the right path. Schedule your FREE phone consultation today!… Simply CLICK HERE.

Small Business Taxes in 2025 - FAQ's

Do you have to file taxes your first year in business?

How can small businesses avoid paying high taxes?

Can you file personal and LLC taxes together?