Bookkeeping is a necessary part of running a small business. But it can be tricky. Many business owners manage their own bookkeeping because they have to, not because they feel confident with business accounting.

Everyone wants to know how they can be compliant and avoid penalties. And it all starts with a reliable accounting system and accurate bookkeeping. We compiled these bookkeeping tips to help small business owners navigate the bookkeeping process:

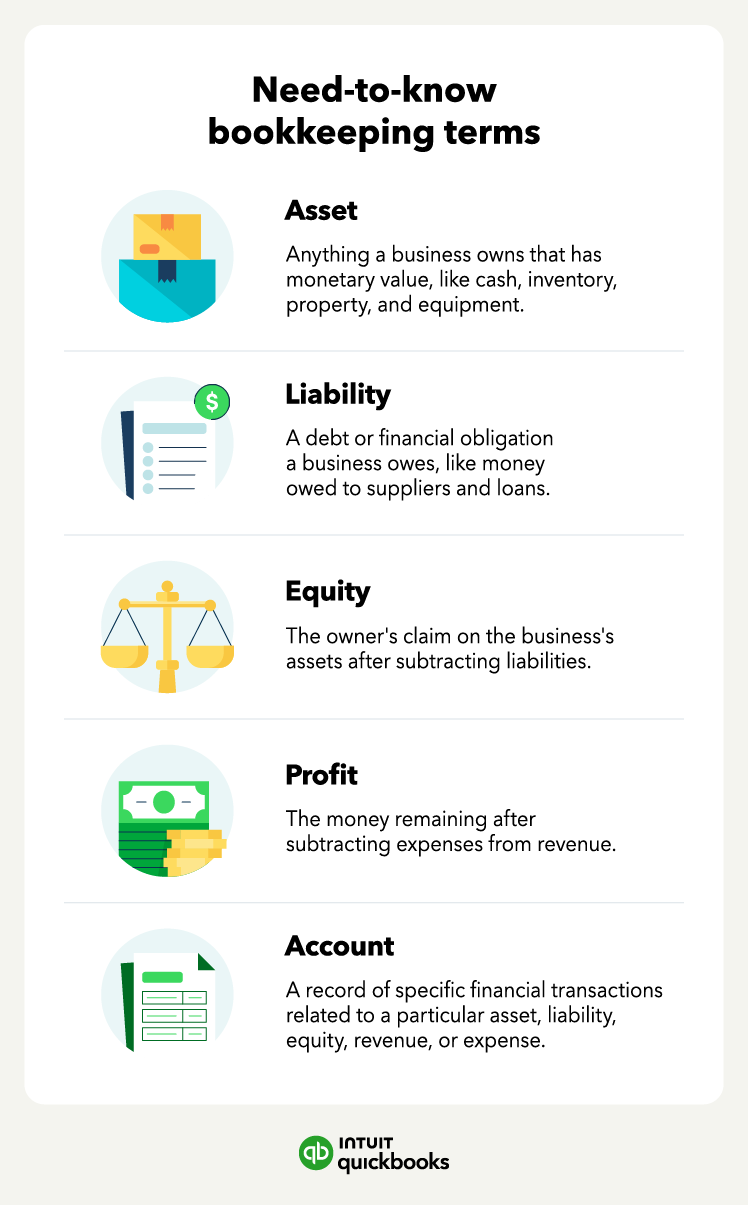

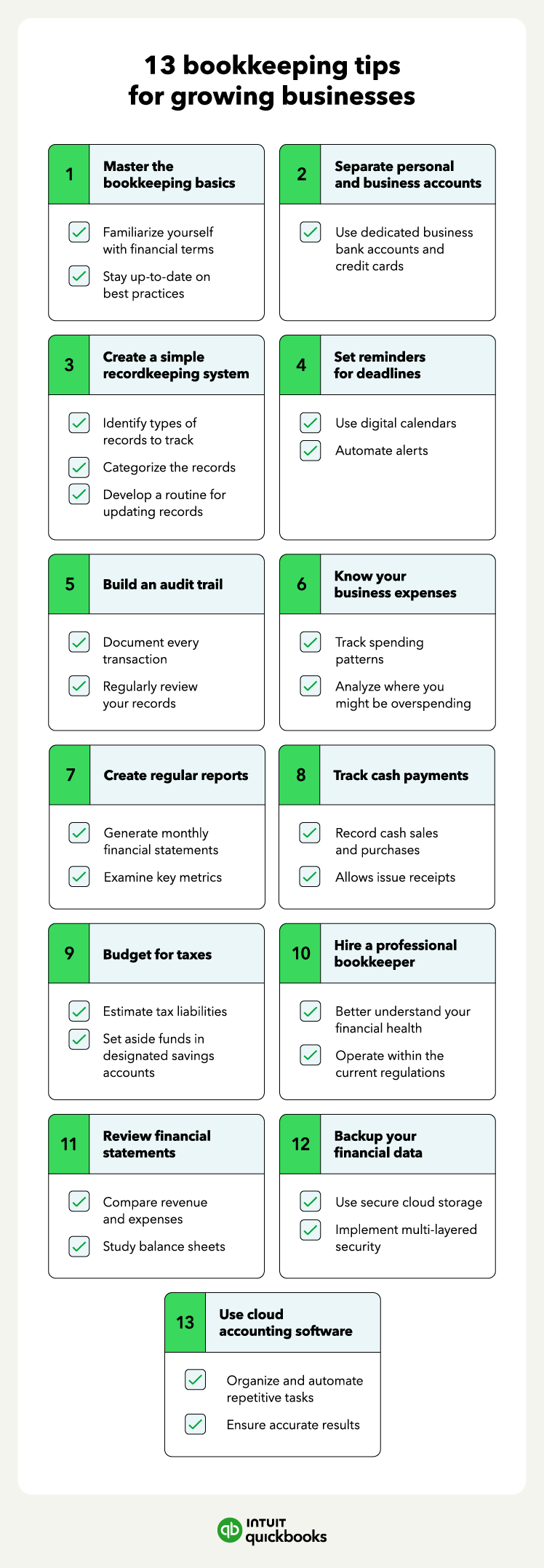

1. Master the bookkeeping basics

Developing a strong foundation in accounting empowers you to confidently navigate the financial world. Understanding key accounting principles, like accrual accounting or the matching principle, will help you interpret financial statements and make informed decisions.

Familiarizing yourself with common financial terms allows you to decipher financial news and reports. Most importantly, staying updated on best practices ensures your bookkeeping methods are efficient and compliant with regulations.

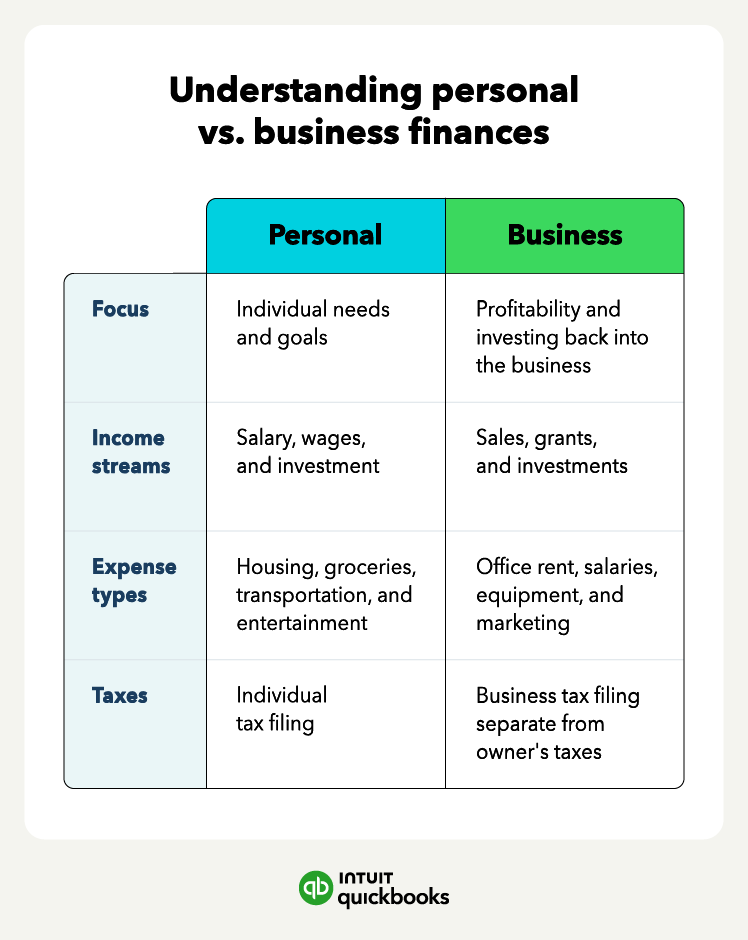

2. Separate personal and business accounts

A separate business bank account is a good idea for any small business. In fact, if you’ve registered as an LLC or corporation, you’re required to have a separate small business bank account for business finances. Bingham says that the bookkeeping community frowns upon commingling business and personal funds.

The same goes for using dedicated business credit cards instead of your personal cards, so you leave a clear spending trail. If the IRS audits you and your bank statements have personal and business transactions, the IRS may disallow everything.

3. Create a simple record-keeping system

The key to effective record-keeping is consistency and organization. Begin by identifying the types of records you’ll need to track. This could be anything from receipts and bills to medical documents or personal project notes.

Then, create consistent categories for these records. For example, categorize expenses by rent, utilities, and inventory to make finding information easier later.

Maintaining organized files is equally important. Whether you prefer physical folders or digital filing systems, ensure everything is clearly labeled and stored according to your categories.

Finally, develop a routine for updating your records. Consider scheduling a weekly or monthly task, depending on the volume of your records. Regularly updating ensures your information is accurate and up-to-date, saving you time and frustration in the long run.

4. Set reminders for deadlines

Incorporating deadline reminders into your bookkeeping routine can help you avoid missing crucial tax filings or accruing late fees. Use a digital calendar, like the one on your smartphone or computer, to schedule entries for upcoming due dates. Set alerts for these entries to give yourself ample time to prepare and submit necessary documents.

5. Build an audit trail

Building a strong audit trail is essential for financial transparency and simplifies future reviews. This involves documenting every transaction, whether it’s a purchase, a sale, or a transfer, as well as keeping the corresponding receipts and invoices. Regularly reviewing your records allows you to identify discrepancies or missing information early on, ensuring your audit trail remains accurate and complete.

6. Know your business expenses

By tracking your spending patterns over time, you can gain valuable insights into where your money goes. Regularly analyze your expenses to identify where you might be overspending. This can reveal opportunities to:

-

- Cut back on unnecessary subscriptions

-

- Find cheaper alternatives for recurring purchases

-

- Negotiate better deals with vendors

By understanding your spending habits, you can make informed decisions and free up resources to allocate towards your financial goals.

7. Create regular reports

Taking your record-keeping a step further involves generating monthly financial statements. These reports, like a balance sheet or income statement, summarize your financial health.

Key metrics to analyze within financial statements include:

-

- Profit margins

-

- Debt-to-equity ratio

-

- Inventory turnover

You can adjust your strategies by identifying trends and areas for improvement. Perhaps you’ll focus on increasing sales efforts if profits are lagging, or explore how to reduce operating costs if expenses are on the rise.

8. Track cash transactions

Meticulously record every cash transaction, whether it’s a sale or a purchase, to accurately track your cash flow. Always issue receipts to customers for their records and yours. Regularly reconcile your records with your bank statements to ensure all deposits, withdrawals, and bank fees are accounted for. This process will identify any discrepancies, like missing checks or deposits, and maintain a clear picture of your actual cash balance.

9. Budget for taxes

Proactively budgeting for taxes throughout the year can prevent a stressful scramble come filing season. Estimate your potential tax liabilities based on your income and deductions. Periodically set aside funds in designated savings accounts to cover this estimated tax burden.

Staying informed of any changes in tax regulations through resources like the IRS website or a tax professional ensures you’re using the most up-to-date information for the most accurate estimates and deductions possible.

10. Hire a professional bookkeeper

At the end of the day, business owners want to build their businesses, not manage their books. If you find you’re spending too much time trying to work through your finances, it might be time to consider investing in bookkeeping services.

A bookkeeper can help:

-

- Ensure you have the most up-to-date financial information for your business

-

- Organize your books and find mistakes that can stem from using Excel as your primary bookkeeping system

-

- Prepare your income statements, balance sheets, cash flow statements, and other financial reports correctly

-

- Acquire business loans

Most of all, a bookkeeper helps you understand your small business’s financial health, allowing you to make smarter financial decisions.

Run your business with confidence

Get help and guidance when you need it from real QuickBooks experts at Eric Buchholz Bookkeeping… Click HERE to get started today by scheduling your FREE phone consultation.

11. Review financial statements

By analyzing income statements and balance sheets over multiple periods, you can gain valuable insights to guide strategic business decisions. Comparing revenue and expenses in income statements across months or years reveals trends in sales growth, profitability, and cost management.

Similarly, reviewing balance sheets for changes in assets, liabilities, and equity highlights fluctuations in inventory levels, debt obligations, and overall financial strength. Identifying these trends allows you to make informed choices, such as adjusting marketing campaigns to capitalize on rising sales trends.

12. Backup your financial data

Safeguarding your financial data is paramount, and regular backups are the cornerstone of financial security. Use secure cloud storage to ensure your information is accessible from anywhere in case of local hardware failure.

This multi-layered approach protects your data from unforeseen circumstances like natural disasters or data security threats. By prioritizing backups, you guarantee the peace of mind that your financial records are always recoverable, allowing you to focus on your financial goals with confidence.

13. Use cloud accounting software

Selecting reliable cloud accounting software is vital for efficient and secure bookkeeping. These tools offer significant advantages over traditional methods. Accounting software, like QuickBooks Online, helps you organize and automate repetitive tasks related to your financial data, prepare small business taxes, run payroll, do your invoicing, and more.

Additionally, the cloud allows you to access your financial data from any device with an internet connection, granting you flexibility and remote access. Use these tips to successfully bookkeep for your business with confidence and accuracy.

Spend more time growing your business

By prioritizing these bookkeeping tips, you can establish a strong financial foundation that promotes informed decision-making and growth.

Being attentive to your business as it’s growing is crucial when it comes to reaching your goals. Luckily, bookkeepers and bookkeeping software are here to take the stress out of daily administrative tasks and sort out that mountain of paperwork.

Focus on your business and hire a remote bookkeeper with Eric Buchholz Bookkeeping. Take advantage of books that are 100% accurate from bookkeepers with over 25 years of experience for confidence and peace of mind. Schedule your FREE phone consultation today!… Simply CLICK HERE.