Cash Flow Is King — and Bookkeeping Is the Throne

Most small businesses fail not because they don’t have customers or great products — but because they run out of cash. Cash flow is the true lifeblood of your company. And yet, without accurate, up-to-date bookkeeping, you’re essentially piloting your business blindfolded.

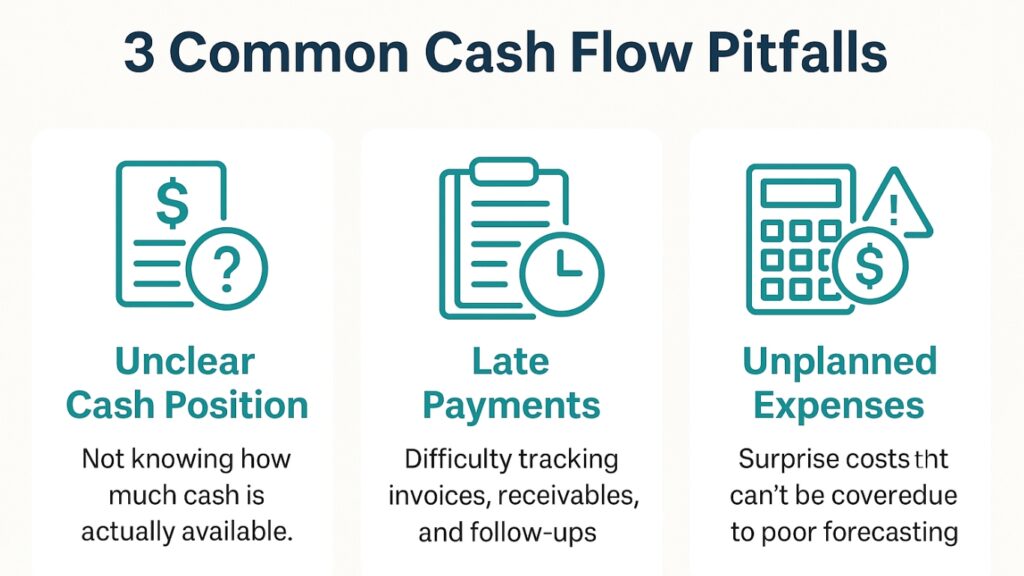

This article digs deeper into why bookkeeping is the unsung hero of cash flow management — focusing on unclear cash position, late payments, and unplanned expenses — and how a remote bookkeeper can transform chaos into clarity.

The Unclear Cash Position Problem — Why Bank Balances Lie

What It Is:

Many business owners glance at their bank balance and assume that’s “available cash.” In reality, that balance may include funds already committed to payroll, taxes, vendor invoices, or upcoming loan payments.

Why It’s Dangerous:

This false sense of security leads to overspending, bounced payments, or missing critical obligations. It also means you’re making decisions without knowing your real working capital.

Real Example:

A retail shop sees $50,000 in the account, invests $15,000 in a marketing campaign, and then struggles to cover $20,000 in vendor invoices and $10,000 in payroll due within two weeks.

How Bookkeeping Fixes It:

-

- Cash Flow Statements: Bookkeepers prepare formal cash flow reports, showing not just what you have but what’s committed.

-

- Rolling Forecasts: A 13-week cash flow forecast can show if you’ll run short weeks in advance.

-

- Expense Earmarking: Bookkeepers can segment funds for taxes, payroll, and debt so you know true “free cash.”

-

- Daily Reconciliations: Real-time transaction tracking keeps your view accurate.

Late Payments — The Silent Killer of Cash Flow

What It Is:

Accounts receivable (AR) are sales you’ve made but haven’t been paid for yet. Without proper tracking, these invoices pile up unpaid, starving your cash flow.

Why It’s Dangerous:

Late or missing payments choke your ability to pay vendors, reinvest, or even cover payroll. Even profitable businesses can fail if AR lags too far behind.

Real Example:

A design firm invoices clients at project completion but has no system to track overdue invoices. By the time they notice, 30% of their monthly revenue is tied up in unpaid bills.

How Bookkeeping Fixes It:

-

- Aging Reports: Bookkeepers produce AR aging reports showing exactly which clients owe how much and for how long.

-

- Automated Reminders: Integrated invoicing sends polite nudges before due dates.

-

- Collections Strategies: Bookkeepers can recommend deposits, retainer billing, or early-payment discounts.

-

- Cash Flow Forecasting: Incorporating expected payments into cash flow models lets you plan expenses more precisely.

Unplanned Expenses — The Budget Busters

What It Is:

Periodic, seasonal, or unexpected costs can hit your cash flow hard — license renewals, equipment breakdowns, tax bills, or employee benefits changes.

Why It’s Dangerous:

When unbudgeted costs arise, you may resort to credit cards or loans, paying high interest or damaging vendor relationships.

Real Example:

A restaurant forgets about its annual liquor license fee due during a seasonal downturn. Without a reserve, it scrambles to cover the payment, delaying vendor checks.

How Bookkeeping Fixes It:

-

- Historical Data Analysis: Bookkeepers identify spending patterns and recurring costs.

-

- Accrual Accounting: Even if you pay annually, bookkeepers can expense monthly to build reserves.

-

- Budget vs. Actual Reports: Spot overspending early and adjust.

-

- Emergency Funds: Accurate forecasts help you set aside a rainy-day fund.

Run your business with confidence

Get help and guidance when you need it from real bookkeeping experts at Eric Buchholz Bookkeeping… Get Started right HERE!

How a Remote Bookkeeper Transforms Cash Flow Management

Beyond Data Entry — A Strategic Partner:

Remote bookkeepers do more than record transactions. They integrate systems, monitor KPIs, and proactively alert you to cash flow risks.

Key Advantages:

-

- Real-Time Dashboards: See bank balances, upcoming payables, and AR aging in one place.

-

- Integrated Systems: Linking bank feeds, POS, payroll, and invoicing creates a single source of truth.

-

- Scalable Expertise: Remote bookkeepers grow with your business — no need to hire staff as you scale.

-

- Proactive Problem-Solving: They flag anomalies or trends before they become emergencies.

Security and Accessibility:

-

- Cloud-Based Tools: Access your numbers from anywhere, anytime.

-

- Secure Data Transfers: Encrypted portals and two-factor authentication keep your information safe.

-

- Audit Trail: Every transaction documented and verifiable, reducing risk.

Advanced Cash Flow Best Practices With a Remote Bookkeeper

-

- Adopt a Rolling 13-Week Cash Flow Forecast — Predict shortages before they happen.

-

- Implement AR Policies — Deposits, retainers, and automated reminders.

-

- Track KPIs Weekly — Days Sales Outstanding, Current Ratio, Operating Cash Flow.

-

- Plan for Seasonality — Use historical data to forecast slow periods and pre-build reserves.

-

- Separate Funds for Taxes & Payroll — Automatic transfers to dedicated accounts.

The Strategic Impact of Clean Cash Flow Management

-

- Investor & Lender Confidence: Clean, predictable cash flow boosts your creditworthiness.

-

- Stronger Vendor Relations: Paying on time earns discounts and priority.

-

- Employee Morale: Payroll is never delayed, boosting trust.

-

- Growth Opportunities: Ready cash lets you seize discounts, hire strategically, or invest in marketing.

Visual Ideas for This Blog

-

- Infographic: “3 Big Cash Flow Pitfalls” with icons.

-

- Dashboard Mockup: Real-time AR aging + cash forecast.

-

- Flowchart: “How Remote Bookkeeping Flows Data from Bank to Forecast.”

-

- Before/After Photo: Stressed owner with overdue invoices vs. relaxed owner with clear dashboard.

Stop Guessing, Start Knowing

Every unclear balance, unpaid invoice, or unplanned expense chips away at your business’s stability. By partnering with a skilled remote bookkeeper, you can:

-

- See your true cash position every day

-

- Get paid faster by tracking receivables proactively

-

- Plan ahead for taxes and surprise costs

-

- Turn your bookkeeping into a growth engine

You’ve worked hard to build your business. Don’t let cash flow chaos hold you back. Schedule a free consultation today to learn how we can transform your bookkeeping and cash flow management — freeing your time and giving you peace of mind.

Ready to get started?

Take routine bookkeeping off your never-ending to-do list with the help of a certified professional. At Eric Buchholz Bookkeeping, we can help ensure that your business’s books close every month, and you’re primed for tax season. Our expert certified QuickBooks ProAdvisors have over 25 years of experience working with small business bookkeeping across various industries.

Whether you’re learning how to streamline your accounting to save time, or how to set-up your chart of accounts for the first time, Eric Buchholz Bookkeeping can guide you down the right path. Schedule your FREE phone consultation today!… Simply CLICK HERE.