Keeping track of your 1099 forms and filing your taxes can be overwhelming. The paperwork and various self-employed tax deductions are time-consuming to work through. We’ll walk you through the top self-employed tax deductions every business owner should consider claiming and guide you through the process to help you file your taxes accurately.

Here are the 17 most common self-employed tax deductions for this year… Grab ’em while they’re hot!

While tax rules can be complex, self-employed professionals can deduct many business-related expenses. You want to take advantage of all the legal tax deductions you can. This will help reduce your tax bill and ensure you maximize profits. Let’s start with six of the most common tax deductions:

1. Home office

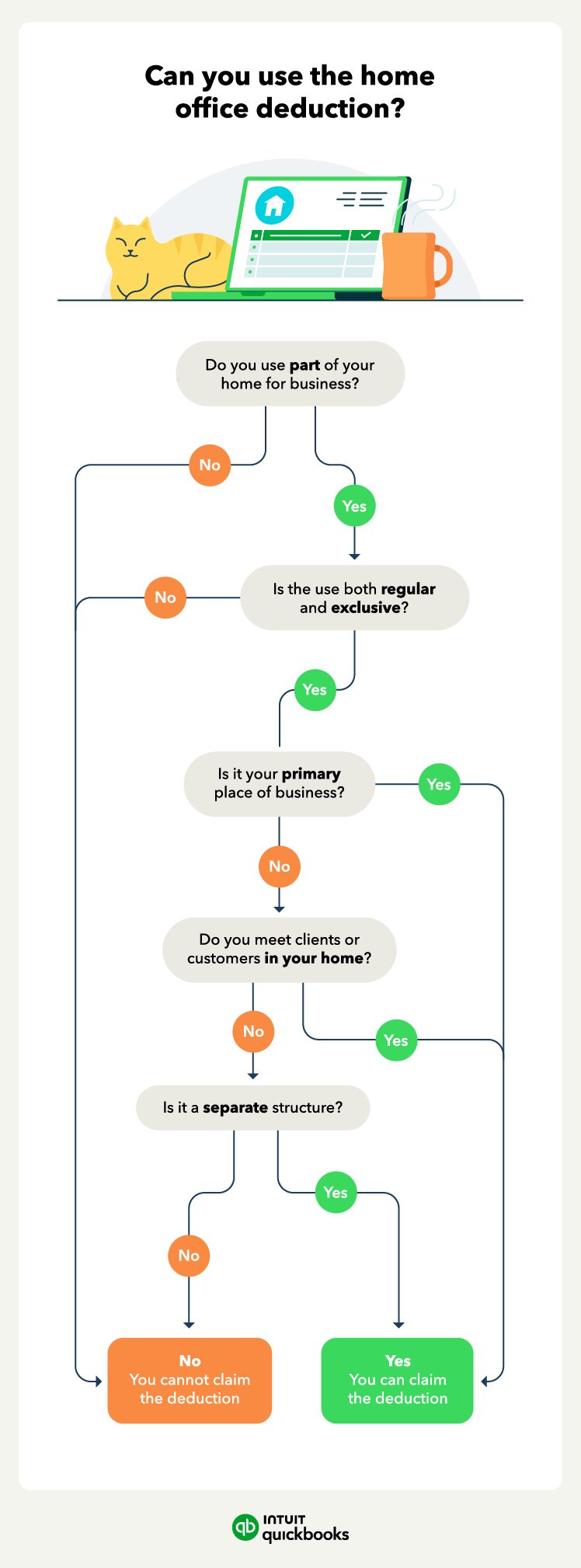

If you use part of your home for business purposes, you can take a deduction based on the square footage of your office. This deduction is available to those who use part of their home regularly and exclusively for business purposes.

To decide whether or not you can use the home office deduction, work through the following flowchart:

After determining whether you can take the home office deduction, it’s time to figure out which method to use. You can use either method, so it’s best to use the method that gives you the highest deduction.

Regular method

There are two methods to choose from—regular and simplified. The regular method allows you to deduct part of your home expenses, such as rent, mortgage interest, repairs, and utilities.

To calculate the home office deduction using the regular method:

- Add up all your home-related expenses, such as rent and repairs.

- Measure the square footage of your office area.

- Divide your home office square footage by your total home square footage.

- Multiply that percentage by your total home expenses.

For example, say your home office is 150 square feet, your home is 2,000 square feet, and your yearly home expenses are $15,000.

Your home office deduction using the regular method is:

- (Office square footage / total home square footage) x home expenses

- (150 / 2,000) x $15,000 = $1,125

One thing to note as well, if you do sell your home in the future, your gain may also be subject to depreciation recapture. The simplified method is a bit simpler.

Simplified method

For the simplified method, you measure the square footage of your office area and multiply it by $5. From our above example, your home office deduction for a 150-square-foot office would be:

- Office square footage x $5

- 150 x $5 = $750

In our example, the regular method has a higher deduction amount, but it does take more work. Also, note that the simplified method has a $1,500 deduction limit. Even if your home office is more than 300 square feet, you can only deduct $1,500.![]() You can deduct a percent of your total home expense OR $5 per square foot (up to $1,500).

You can deduct a percent of your total home expense OR $5 per square foot (up to $1,500).

2. Self-employment tax

If you’re self-employed, you’re responsible for paying self-employment taxes, also known as the Federal Insurance Contributions Act (FICA). The FICA tax amount pays for Social Security and Medicare contributions.

The current self-employment tax rate is 15.3%, which includes 12.4% for Social Security and 2.9% for Medicare. So, if you make $10,000, you’ll need to pay $1,530 in self-employment taxes.

However, 50% of what you pay in self-employment taxes is deductible. For example, if you pay $1,530 in self-employment taxes, you will be able to reduce your taxable income by $765.![]() You can deduct 50% of your self-employment taxes.

You can deduct 50% of your self-employment taxes.

3. Vehicle use

Do you regularly drive to meet clients or suppliers? If so, you can take advantage of the tax deductions for self-employed individuals to account for vehicle mileage or normal vehicle wear and tear. You can choose between two types of vehicle-related deductions: the standard mileage option or the actual expense option.

Standard mileage rate vs. actual use

The standard mileage rate calculation for your vehicle-use deduction is:

Standard mileage rate deduction = business miles x IRS standard mileage rate

The current IRS standard mileage rate is $0.67 per mile. For example, say you use your personal car to drive 6,000 business miles, then your standard mileage rate deduction is:

- Business miles x standard mileage rate

- 6,000 miles x $0.655 = $4,020

Or you can track all your car expenses and multiply that by the amount of business-related miles you drove. The formula for the actual use deduction is:

Actual use deduction = total vehicle expenses x (business miles / total miles)

For example, your total car expenses were $7,000 for the year. You drove 6,000 miles for business and 4,000 for personal use for a total mileage of 10,000. The actual-use deduction in this example is:

- Total vehicle expenses x (business miles / total miles)

- $7,000 x (6,000 / 10,000) =

- $7,000 x 60% = $4,200

Both the standard mileage and actual use methods both require you to track the miles you drive for business.![]() You can deduct a percentage of your total vehicle expenses OR the standard mileage rate.

You can deduct a percentage of your total vehicle expenses OR the standard mileage rate.

4. Retirement contributions

If you contribute to a retirement plan for yourself, you may be able to deduct these contributions. This includes the individual retirement account (IRA), Simplified Employee Pension (SEP) plan, and 401(k) contributions.

Note that the annual retirement contribution limit will vary based on the retirement account—be sure not to overcontribute, or you could face a tax penalty.![]() You can deduct 100% of your retirement contributions, e.g. 401(k) or IRA contributions.

You can deduct 100% of your retirement contributions, e.g. 401(k) or IRA contributions.

5. Health insurance

Many full-time employees receive health insurance through their employers. However, many professionals need to find their own self-employed health insurance. Those monthly premiums can add up to a hefty chunk of change every month.

Self-employed individuals who meet certain criteria may be able to deduct the cost of health insurance premiums. You can deduct premiums (for yourself and your family) if your business is generating a profit and you’re not eligible to enroll in an employer’s health plan.![]() You can deduct 100% of your health insurance premium payments.

You can deduct 100% of your health insurance premium payments.

6. Travel

Other tax write-offs available to self-employed individuals are travel expense tax deductions. If you travel to visit clients or attend conferences, you may be able to deduct the cost of travel. Business travel expenses include transportation and accommodation costs.

For example, if you are a freelancer who travels to attend networking events, you can deduct the cost of these trips. And if you are a consultant who visits clients, you can also deduct travel costs.

To be eligible for this deduction, you must be able to prove that the travel was ordinary and necessary for your business. When deducting your business travel expenses, you shouldn’t attempt to deduct any expenses associated with sightseeing and leisure travel.![]() You can deduct 100% of your travel expenses, e.g. plane tickets, hotels.

You can deduct 100% of your travel expenses, e.g. plane tickets, hotels.

Run your business with confidence

Get help and guidance when you need it from real bookkeeping experts at Eric Buchholz Bookkeeping… Get Started right HERE!

Those are six of the most common deductions that almost all business owners can use. Now, let’s take a look at some other common deductions for self-employed individuals.

7. Startup costs

If you are just starting your business, you can deduct your startup costs from your taxes. This includes things like legal and professional fees for registering as a self-employed business owner.

It is important to note that you can only deduct up to $5,000 of your startup costs from your self-employment taxes. You will need to write off any costs over the $5,000 deduction over 15 years.![]() You can deduct 100% (up to $5,000) of your startup costs, e.g., incorporation fees and website building costs.

You can deduct 100% (up to $5,000) of your startup costs, e.g., incorporation fees and website building costs.

8. Advertising and marketing

Self-employed people typically engage in marketing to grow their business. If you spend money on advertising for your business, you can deduct these expenses from your taxes.

The IRS allows small business owners to deduct the cost of items like flyers, web advertisements, business cards, and print ads, along with other marketing expenses.![]() You can deduct 100% of your ad and marketing expenses, e.g., social media ads.

You can deduct 100% of your ad and marketing expenses, e.g., social media ads.

9. Meals

Another tax deduction available to self-employed individuals is the meal deduction. This deduction allows you to deduct the cost of meals necessary for your business. You can write off things like meals while entertaining clients.

However, the catch is that you can only deduct 50% of business meals with clients, meals for employees, and office snacks. For meals at companywide parties or food provided for free to the public, you can deduct 100%.![]() You can deduct 50% of your business-related meals and 100% for companywide parties.

You can deduct 50% of your business-related meals and 100% for companywide parties.

10. Software and subscriptions

With many shoppers turning to the internet to research services and products, creating a website can be key to success. Self-employed individuals can deduct costs for their business websites, such as domain and hosting fees.

Other software and subscription expenses you might be able to deduct include accounting software and cloud storage subscriptions. Self-employed individuals can deduct the full cost of any software or subscription if it’s entirely for business use.![]() You can deduct 100% of your software and subscription expenses, e.g., accounting software and cloud storage.

You can deduct 100% of your software and subscription expenses, e.g., accounting software and cloud storage.

11. Office supplies

If you spend money on office supplies for your business, you can deduct these expenses. Typical office supplies may include postage and stationery, but almost any repeat-purchase items you regularly use for your business can be office supplies. For example, highlighters, staplers, paper clips, dry-erase markers, and tape.![]() You can deduct 100% of your office supplies, e.g., pens and paper, printing supplies.

You can deduct 100% of your office supplies, e.g., pens and paper, printing supplies.

12. Internet and phone

Small business owners who work at home—whether you consider yourself self-employed or a freelancer—can deduct part of their internet and phone costs. If you only use your internet or phone for business purposes, you can deduct the entire bill. But if you use either for personal use, you can only deduct the business use part.

For example, you’ll want to track your time if you use your cellphone for personal and business use. If you use your personal cell phone for business 50% of the time, you can deduct half your cell phone bill.![]() You can deduct 100% of your business-related internet and phone use.

You can deduct 100% of your business-related internet and phone use.

There are even more tax deductions self-employed individuals can take—although these next five might be less common given the nature of self-employed businesses. However, they’re still worth capitalizing on if available to you.

13. Membership dues

If you spend money on dues for professional organizations, you can use those expenses to lower your tax burden. Memberships must be for your business, however.

For example, an accountant may consider the National Society of Accountants or the American Accounting Association as necessary memberships. You should keep detailed records of both your education expenses and dues.![]() You can deduct 100% of your membership dues, e.g., nonprofit organization dues.

You can deduct 100% of your membership dues, e.g., nonprofit organization dues.

14. Business insurance

Any type of insurance you have for your business is tax-deductible. For example, some businesses have to carry liability insurance, and any permits you pay for it are deductible.

You can also deduct insurance premiums that are helpful to your business, such as business income coverage or cybersecurity insurance. Note that premiums for life insurance are typically not tax-deductible.![]() You can deduct 100% of your business insurance, e.g., liability and cyber insurance.

You can deduct 100% of your business insurance, e.g., liability and cyber insurance.

15. Interest expenses

If you have a business credit card, you can likely deduct any interest you pay. This also goes for business loans. For example, if you took out a loan to buy equipment for your business, any interest paid would be tax-deductible.

But you can only take an interest deduction that’s up to 30% of your adjusted taxable income. For example, if your adjusted taxable income is $50,000, your interest expense deduction cannot exceed $15,000.

Note the loan or credit card charges must be for your business. Interest paid for charges or loans related to personal use is not deductible.![]() You can deduct 100% (up to 30% of adjusted taxable income) of your travel interest expenses, e.g., credit card and loan interest.

You can deduct 100% (up to 30% of adjusted taxable income) of your travel interest expenses, e.g., credit card and loan interest.

16. Rent and utilities

If you rent office space, you can deduct the rent and utilities you pay. Or, if you rent space for other things related to your business, such as a warehouse, storage facility, or manufacturing plant, you can deduct those as well.

Note that you cannot deduct prepaid rent. You can only take a tax deduction for the time the property is in use during the tax year.

For example, say you pay $12,000 for a year of rent on July 1. You can only take a rental deduction of $6,000—the six months you will use the property during that tax year.![]() You can deduct 100% of your rent and utilities, e.g., warehouse and storage rent.

You can deduct 100% of your rent and utilities, e.g., warehouse and storage rent.

17. Education

As a small business owner, finding ways to stand out from your competition is key. To stay ahead of the pack, many self-employed individuals attend online business courses and educational seminars.

The cost of these expenses can help you and your business, so the IRS lets freelancers deduct professional development expenses in full. This includes things like books and webinars as well. But they cannot be for general education—they must be related to your business.![]() You can deduct 100% of your education expenses, e.g., webinars and workshops.

You can deduct 100% of your education expenses, e.g., webinars and workshops.

If you’re self-employed, you can write off many expenses. Here’s a recap of the 17 best tax write-offs for self-employed individuals:

| Deduction | Examples | Amount |

|---|---|---|

| Home office | Maintenance and repairs, insurance | Percentage of expenses OR $5 per square foot (up to $1,500) |

| Self-employment tax | Social Security and Medicare taxes | 50% |

| Vehicle use | Fuel, maintenance | Percentage of vehicle expenses OR Standard mileage rate |

| Retirement contributions | IRA, 401(k) contributions | 100% |

| Health insurance | Premiums for you and your family | 100% |

| Travel | Plane tickets, hotels, rental cars | 100% |

| Startup costs | Incorporation fees, website | 100% (up to $5,000) |

| Advertising and marketing | Social media ads | 100% |

| Meals | Client meetings, office snacks | 50% (100% for company wide parties) |

| Software and subscriptions | Cloud storage, accounting software | 100% |

| Office supplies | Pens, printer ink, paper | 100% |

| Internet and phone | Cell phone, home internet | 100% |

| Membership dues | Dues for professional organizations | 100% |

| Business insurance | Liability, cyber | 100% |

| Interest expenses | Credit card, business loan interest | 100% (up to 30% of taxable income) |

| Rent and utilities | Office space, warehouse | 100% |

| Education | Workshops, webinars | 100% |

Created with Datawrapper

Find peace of mind come tax time

Filing self-employed and sole proprietorship taxes can be stressful—and the self-employed tax deductions may be confusing. However, by taking advantage of all possible deductions and understanding the requirements, you can minimize your tax burden and grow your business.

Use self-employed accounting software like QuickBooks Self-Employed to track expenses throughout the year and automatically post them as deductions for you.

Ready to get started?

Take routine bookkeeping off your never-ending to-do list with the help of a certified professional. At Eric Buchholz Bookkeeping, we can help ensure that your business’s books close every month, and you’re primed for tax season. Our expert certified QuickBooks ProAdvisors have over 25 years of experience working with small business bookkeeping across various industries.

Whether you’re learning the most common tax deductions for your business, or how to avoid the common errors when it comes to record keeping, Eric Buchholz Bookkeeping can guide you down the right path. Schedule your FREE phone consultation today!… Simply CLICK HERE.