What is transactional accounting? Transactional accounting is the process of recording the money coming in and going out of a business—its transactions. It’s part of the accounting cycle.

As a small business owner, it’s essential to have a clear picture of your company’s financial health. This starts with an understanding of the accounting cycle.

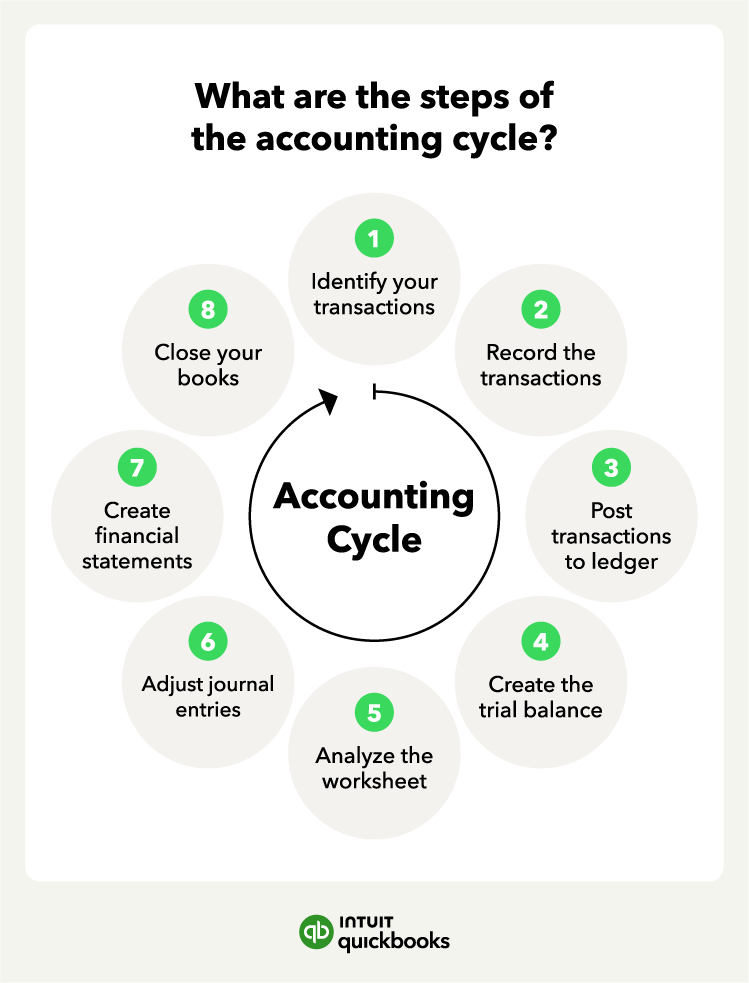

Bookkeeping can be a daunting task, even for the most seasoned business owners. But having a professional bookkeeper can help you manage your small business’s internal accounting cycle to set you up for success so you can continue to do what you love. There are eight accounting cycle steps that can get you started.

Step 1. Identify your transactions

The first step in the accounting cycle is to identify your business’s transactions, such as vendor payments, sales, and purchases. It’s helpful to also note some other details to make it easier to categorize transactions.

Important information to identify includes:

- Transaction dates.

- Product prices.

- Amounts paid.

Bookkeepers or accountants are often responsible for recording these transactions during the accounting cycle.

Step 2. Record the transactions

Once you identify your business’s financial accounting transactions, it’s important to create a record of them. You can do this in a journal, or you can use accounting software to streamline the process.

A few things to remember when recording transactions:

- Maintain chronological order of transactions.

- Ensure credits and debits balance each other out when using double-entry accounting.

- Include important notes for the accountant for easier reconciliation.

Run your business with confidence

Get help and guidance when you need it from real bookkeeping experts at Eric Buchholz Bookkeeping… Get Started right HERE!

Step 3. Post transactions to the general ledger

The next step in the accounting cycle is to post the transactions to the general ledger. Think of the general ledger as a summary sheet where all transactions are divided into accounts. It lets you track your business’s finances and understand how much cash you have available.

Step 4. Create the trial balance

Once posted to the general ledger, you need to balance all of your business’s transactions. Do this at the end of the accounting period, which can be monthly, quarterly, or annually, depending on the company. Known as the “trial balance,” this provides insight into the financial health of your company and can help you identify any discrepancies in your bookkeeping.

Step 5. Analyze the worksheet

The next step is worksheet analysis. Use a worksheet to balance your company’s debits and credits. If you have debits and credits that don’t balance, you have to review the entries and adjust accordingly.

Step 6. Adjust journal entries

Before you create your financial statements, you need to make adjustments to account for any corrections for accruals or deferrals.

An example of an adjustment is a salary or bill paid later in the accounting period. Because it was recorded as accounts payable when the cost originally occurred, it requires an adjustment to remove the charge.

Step 7. Create financial statements

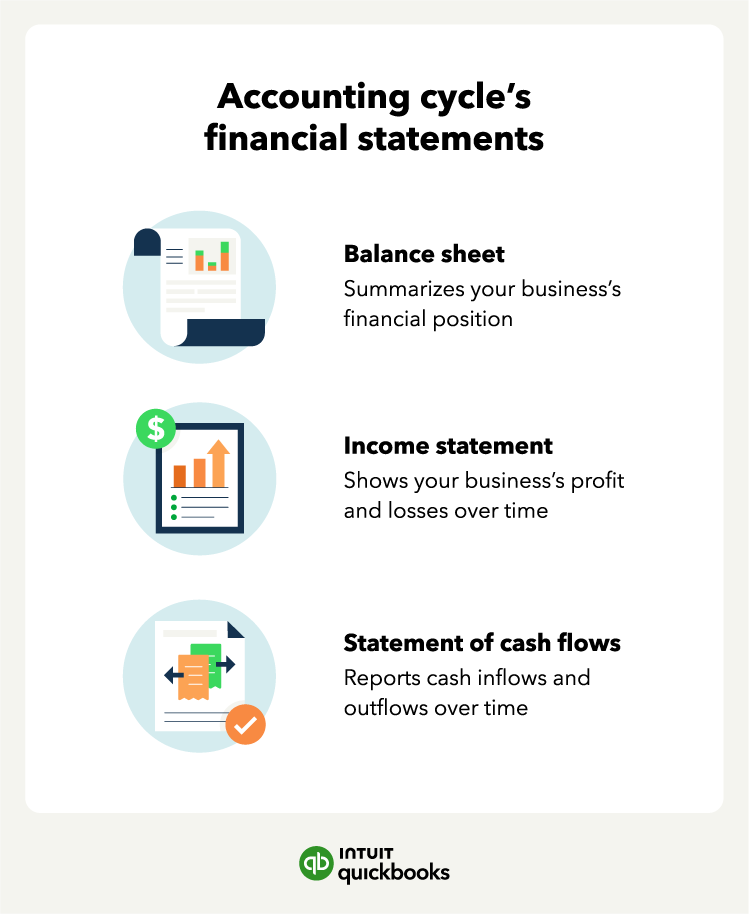

The next step is to generate financial statements from the trial balance. These include a balance sheet, an income statement, and a cash flow statement. Here’s a brief explanation of each financial statement:

- Balance sheet: A summary of a company’s financial position on a specific date, created by subtracting assets from liabilities to determine equity. This is different from an income statement, which reflects how a company performed over a period of time—not on a specific date.

- Income statement: A report of a business’s profit or loss over time. Typically, an income statement is created monthly or annually by subtracting expenses from revenues to determine net income or profit.

- Statement of cash flow: A record of a company’s cash inflows and outflows over time, separated into operating, investing, and financing transactions. The ending balance in the cash flow statement must equal the company’s cash balance on the balance sheet.

Step 8. Close your books

After you complete your financial statements, you can close the books. This means your books are up to date for the accounting period, and it signifies the start of the next accounting cycle. Then, you begin the accounting process all over at step one.

Tips for successfully managing the accounting life cycle

Completing the accounting cycle can be time-consuming, especially if you don’t feel organized. Here are some tips to help streamline the bookkeeping process and save you time.

Know your timing

Whether your accounting period is monthly, quarterly, or annually, timing is crucial to implementing the accounting cycle properly. Mapping out plans and dates that coincide with your accounting deadlines will increase productivity and results.

Troubleshoot errors quickly

Identifying and solving problems early in the accounting cycle leads to greater efficiency. It is important to set proper procedures for each of the eight steps in the process to create checks and balances to catch unwanted errors.

Modify the process to fit your needs

There is no one-size-fits-all solution for accounting practices. Each industry, company, and team operate differently. You might find early on that your system needs to be tweaked to accommodate your accounting habits.

Set your team up for success

If you have a staff, give them the tools they need to succeed in implementing the accounting cycle. This could mean providing quarterly training on best practices, meeting with your staff each cycle to find their pain points, or equipping them with the proper accounting tools. The better prepared your staff is, the more efficient they can be.

Try accounting software to lighten the load

Tools such as QuickBooks Online can help streamline the accounting process. There are many tasks that you can automate through a business accounting platform.

Spend more time growing your business

As your business grows, so will your accounting needs. Creating an accounting process may require a significant time investment. Setting up an effective process and understanding the accounting cycle can help you produce financial information that you can analyze quickly, helping your business run more smoothly.

You can connect with Eric Buchholz Bookkeeping for bookkeeping help. They can provide guidance, answer questions, and teach you how to do tasks in QuickBooks, so you can stay organized and be ready for tax time.* Increase your business expertise—without adding to your payroll.

Ready to get started?

Take routine bookkeeping off your never-ending to-do list with the help of a certified professional. At Eric Buchholz Bookkeeping, we can help ensure that your business’s books close every month, and you’re primed for tax season. Our expert certified QuickBooks ProAdvisors have over 25 years of experience working with small business bookkeeping across various industries.

Whether you’re learning what transactional accounting encompasses, or how to just manage the accounting cycle, Eric Buchholz Bookkeeping can guide you down the right path. Schedule your FREE phone consultation today!… Simply CLICK HERE.