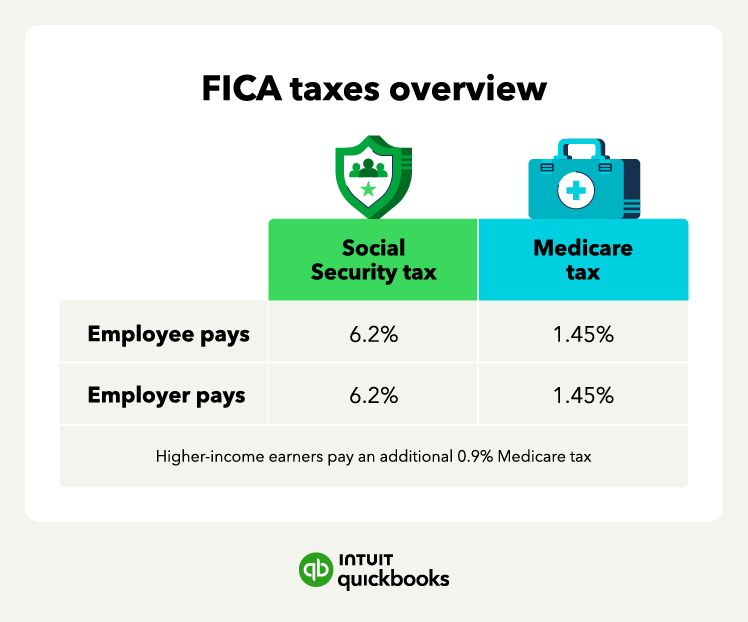

FICA tax definition: FICA taxes include a Social Security tax rate of 6.2% and a Medicare tax rate of 1.45%.

Keeping track of all the types of payroll taxes is never easy. This includes understanding Federal Insurance Contributions Act (FICA) taxes when trying to meet payroll tax withholding requirements.

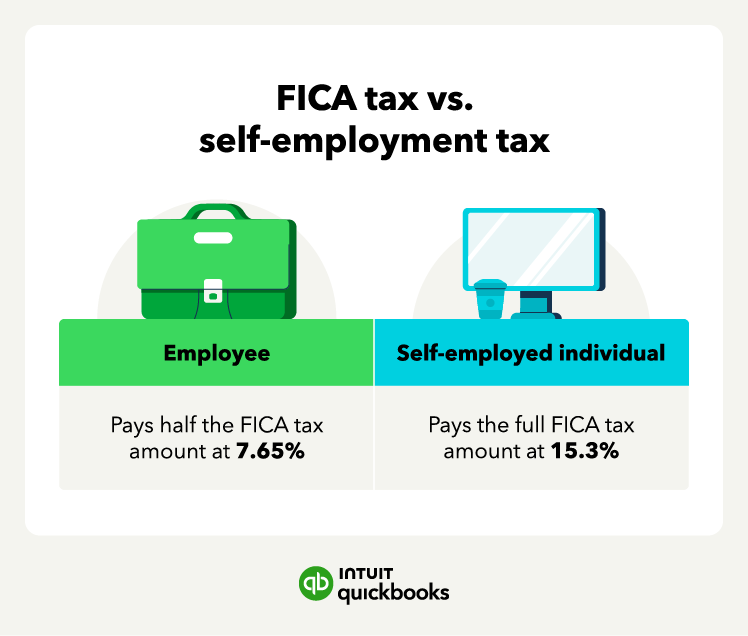

FICA taxes include Social Security and Medicare taxes for a total rate of 15.3%. Employers and employees split the FICA tax payment, each paying 7.65%. However, self-employed individuals must pay the whole FICA amount.

Self-employed FICA taxes are the same as self-employment taxes, but the process for reporting and paying differs if you’re an employer versus a self-employed individual. Let’s look at exactly what FICA taxes are, the specific FICA tax rates and limits, and how to calculate and file these taxes.

How do FICA taxes work?

FICA taxes, short for Federal Insurance Contributions Act, are payroll taxes that fund Social Security and Medicare programs. As a small business owner, you must deduct these taxes from your employees’ paychecks.

You can make calculating and deducting these taxes more streamlined and alleviate concerns of payroll penalties with payroll software that has built-in tax penalty protection like QuickBooks Payroll.

FICA taxes are split between the employer and the employee. The employer is responsible for contributing an equal amount to the employee’s share of FICA taxes. For instance, if the employee pays 6.2% for Social Security, the employer also pays 6.2%. Similarly, for Medicare taxes, both the employee and employer each pay 1.45%.

There’s an income limit for paying Social Security tax. For example, you only pay Social Security taxes on income up to $168,600 in 2024. In other words, if you make $180,000, you’ll only pay Social Security taxes on the first $168,600. However, there’s an additional Medicare tax of 0.9% for high earners making over $200,000 as single filers or $250,000 for married filing jointly.

For self-employed individuals, the importance of FICA taxes becomes even more significant. Everyone pays both FICA taxes and income taxes. If you’re an employee, your company manages the FICA tax payments for you. This means self-employed individuals must set aside a portion of their earnings to cover both employee and employer contributions.

Why do you have to pay FICA taxes?

FICA taxes are mandatory payroll withholdings that fund two key social programs—Social Security and Medicare. These programs provide financial security and health care for individuals during their retirement years and in the case of certain disabilities.

By making these contributions, you become eligible for Social Security retirement benefits, disability benefits, and survivor benefits. You also get Medicare coverage, which helps cover medical expenses for those over 65 or with certain disabilities.

FICA tax exemptions

FICA tax exemptions are provisions that exempt certain individuals or groups from paying FICA taxes. Current FICA tax exemptions include:

-

- College students attending university or vocational school can get FICA tax exemptions if they also work part-time.

-

- Religious groups, such as ministers and members of a religious order, can be eligible for FICA tax exemptions.

-

- Nonresident aliens may be exempt from FICA taxes on earnings from employment in the country.

To be eligible for these exemptions, you may have to meet certain requirements, such as specific visa and immigration criteria for nonresident aliens.

Run your business with confidence

Get help and guidance when you need it from real bookkeeping experts at Eric Buchholz Bookkeeping… Get Started right HERE!

FICA taxes for self-employed

For self-employed workers, such as freelancers and independent contractors, the process of paying FICA taxes differs from W-2 employees. Self-employed individuals are responsible for paying both the employer and employee portions of the FICA taxes, as they are essentially both the employer and employee.

The total FICA tax rate is 15.3%, with 12.4% allocated for Social Security and 2.9% for Medicare. Self-employed workers need to contribute the full 15.3% of their net income to cover both portions.

What is the Self-employed Contributions Act?

The Self-Employed Contributions Act (SECA) is the equivalent of FICA for self-employed individuals. The SECA tax, or self-employment tax, establishes the guidelines for self-employed individuals to pay Social Security and Medicare taxes.

While FICA is a payroll tax, SECA (self-employment tax) is an income tax due on 92.35% of your self-employment earnings. Self-employed workers are responsible for paying both the employer and employee portions of the tax.FYI: Self-employed individuals can deduct half their self-employment tax from their income to offset the burden of paying the employer and employee portions of FICA taxes.

How to calculate and file FICA taxes

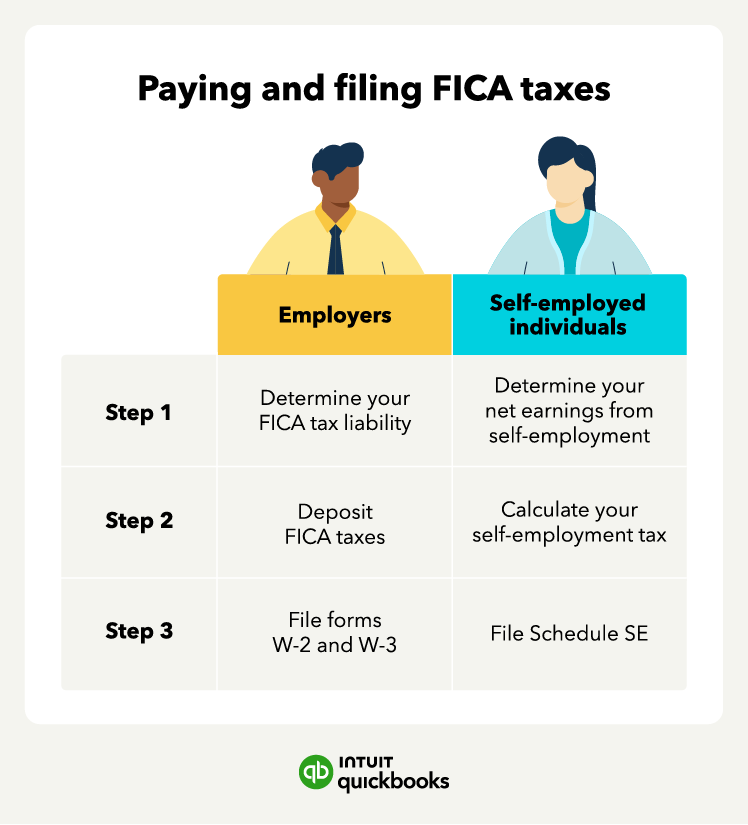

Calculating and filing FICA taxes is different for employers and self-employed individuals.

If you’re an employer, you can file and pay FICA taxes in three steps:

-

- Determine your FICA tax liability: Employers are responsible for withholding the employee portion of FICA taxes from their employee’s wages, but also for paying the employer portion.

-

- Pay FICA taxes: Employers must pay their FICA taxes either semiweekly or monthly to the IRS, as well as file Form 941 quarterly or Form 944 annually, depending on the company size.

-

- File forms W-2 and W-3: Employers file W-2 forms with the Social Security Administration for each employee annually to report the employee’s wages and FICA taxes withheld. Employers must also file Form W-3, which summarizes the information on all Forms W-2 that they filed.

Filing and paying FICA taxes is a bit different for self-employed individuals. Sole proprietors and freelancers don’t have an employer to collect and pay FICA taxes. Instead, they pay both the employer and worker amounts.

If you’re self-employed, you can pay and file self-employment taxes using these three steps:

-

- Determine your net earnings from self-employment: Calculate your net earnings from self-employment, which is your total income from self-employment activities minus your self-employment deductions.

-

- Calculate your self-employment tax: To calculate your self-employed FICA and self-employment tax liability, multiply your income from self-employment by 92.35%. Then multiply that figure by 15.3% (assuming it’s less than the current Social Security income limit).

-

- File Schedule SE: You’ll file Schedule SE on Form 1040 to report your self-employment tax liability. Schedule SE helps calculate the amount of self-employment tax you owe and what tax you can deduct from your adjusted gross income.

The self-employment tax calculation uses 92.35% of your income to account for the fact that regular employees only pay FICA taxes on their gross pay, while self-employed workers can deduct half of the self-employment tax as a business expense.FYI: Self-employed individuals who expect to owe more than $1,000 in income tax come tax time must make quarterly estimated tax payments to the IRS.

FICA tax rates and limits

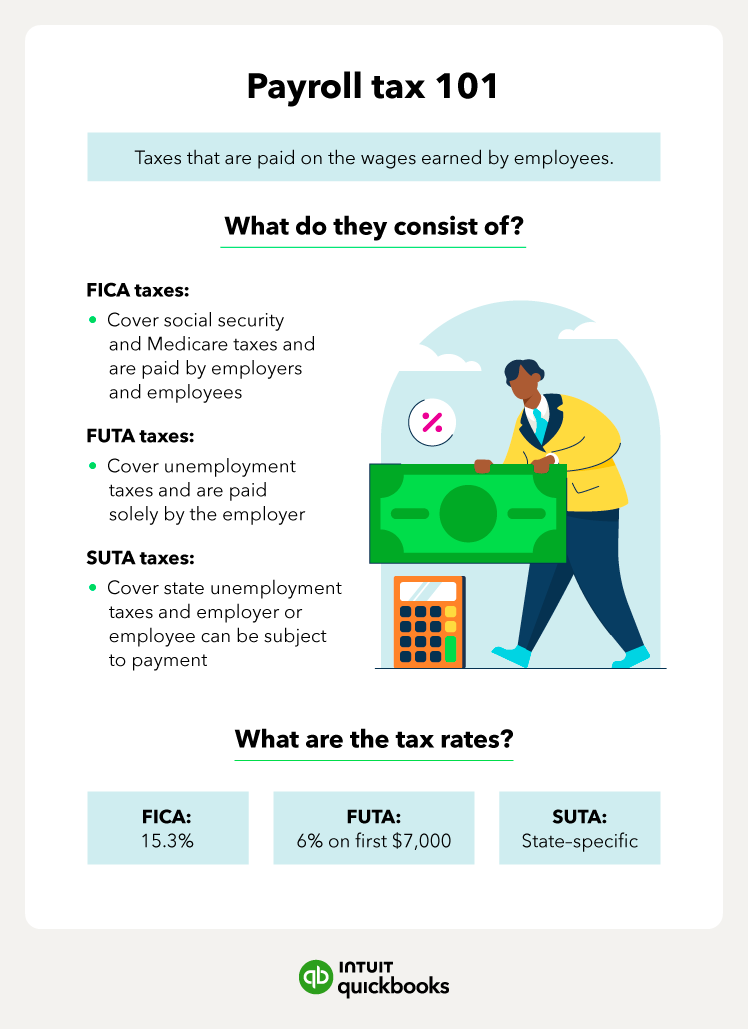

FICA taxes are just one part of payroll withholdings, which also include unemployment taxes. Federal unemployment tax withholding is known as FUTA, while state unemployment is SUTA.

The current FICA tax rate has been the same since 1990, currently at 15.3%, which includes 12.4% for Social Security taxes and 2.9% for Medicare taxes.

The Social Security tax rate is 6.2% for both employees and employers. There is an earnings limit for Social Security taxes, however. For 2024, this limit is $168,600, meaning that only income up to this amount is subject to Social Security tax. Any earnings above this limit are not subject to Social Security tax.

The Medicare tax rate is 1.45% for both employees and employers. Unlike the Social Security tax, there is no earnings limit for the Medicare tax. However, there is an additional 0.9% Medicare tax that applies to income (whether it be employee wages or self-employment income) for earnings above:

-

- $250,000 for married filing jointly filers

-

- $125,000 for married filing separately filers

-

- $200,000 for all others, including single filers

Tip: You can use a self-employment tax calculator to help guide you in determining how much you can expect to owe.

Find peace of mind come tax time

FICA taxes fund Social Security and Medicare programs, which provide critical support for individuals in their retirement years and offer health care benefits. Paying FICA taxes grants self-employed individuals access to Social Security benefits.

Business owners and self-employed individuals who neglect FICA tax obligations risk tax penalties and fines. Accounting software built for self-employed individuals, like QuickBooks Solopreneur, can help you accurately calculate and file taxes.

Ready to get started?

Take routine bookkeeping off your never-ending to-do list with the help of a certified professional. At Eric Buchholz Bookkeeping, we can help ensure that your business’s books close every month, and you’re primed for tax season. Our expert certified QuickBooks ProAdvisors have over 25 years of experience working with small business bookkeeping across various industries.

Whether you’re learning how FICA taxes actually work, or how to calculate and file your FICA taxes, Eric Buchholz Bookkeeping can guide you down the right path. Schedule your FREE phone consultation today!… Simply CLICK HERE.