EIN number meaning: An employer identification number (EIN), also known as a federal tax ID number, is a nine-digit number the IRS uses to identify businesses.

Business owners, solopreneurs, and self-employed individuals often question whether they need an employer identification number (EIN). Some small businesses can operate without one. However, it’s always best to do your research first to ensure your setup for success. Let’s look at what an EIN number is, who needs one, and how to use it.

Getting a business EIN number, also known as a business tax ID number, helps establish your business and will help you keep your legal and financial matters in order.

Do you need an EIN number?

Most businesses can benefit from an EIN.

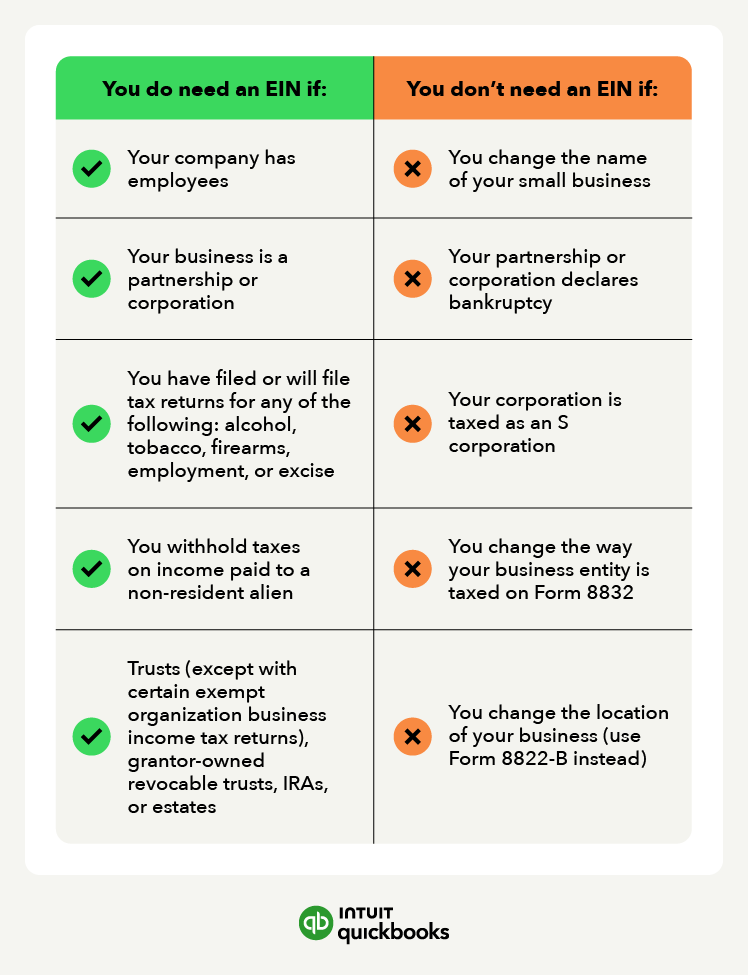

According to the IRS, your business will need an EIN if:

- Your company has employees

- Your business is a partnership or corporation

- You have filed or will file tax returns for any of the following: alcohol, tobacco, firearms, employment, or excise taxes

- You withhold taxes on income paid to a nonresident alien

Beyond filing taxes, you may also need an EIN to:

- Open a business bank account

- Apply for a company credit card

- Apply for business permits or licenses

- Apply for a business loan

- Send 1099 forms to contractors

Note that having an EIN is necessary if your business pays employees or independent contractors.

Run your business with confidence

Get help and guidance when you need it from real bookkeeping experts at Eric Buchholz Bookkeeping… Get Started right HERE!

Benefits of an EIN number for your business

While an EIN isn’t always necessary, it does have benefits. This includes:

- Separating business and personal: An EIN keeps your business and personal finances separate, which is beneficial when paying employees and yourself or applying for a business loan.

- Building credit: Establishing credit for your business will serve you well as you grow and need financing. Instead of using your own credit, you can use your business’s credit.

- Protecting yourself: Using an EIN can protect your personal assets from business failures. For example, in the event that your business files for bankruptcy, you can help protect your personal assets by keeping your personal and business finances separate.

Another reason you may want to apply for an EIN is your privacy. For example, if you’re a contractor who works with a large number of clients, disclosing your Social Security number may expose you to identity theft.

How to get an EIN

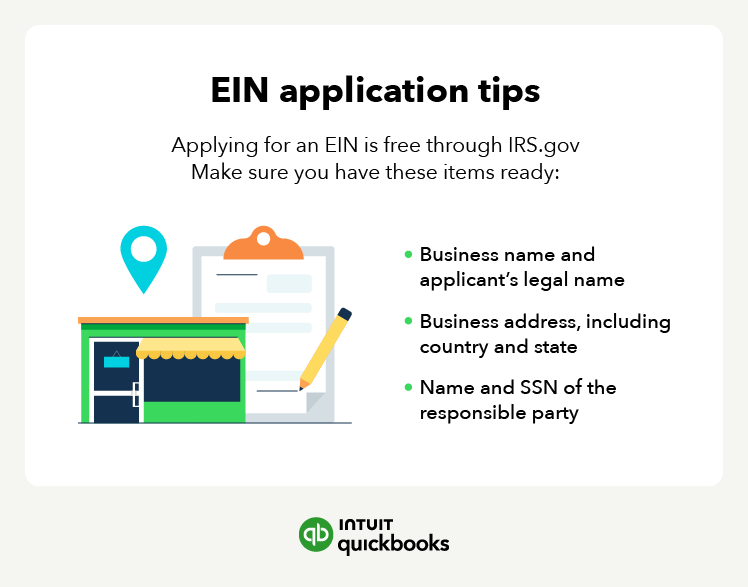

The IRS allows you to apply for an EIN for free on its website. The application process is relatively easy. In most cases, you can apply online and receive your EIN immediately.

Here’s a summary of what to expect when filing:

- Determine eligibility: The IRS has a shortlist of requirements you must meet before applying for an EIN.

- Understand the application: This simply means you have to finish the application all in one session, and you can’t have more than 15 minutes of inactivity.

- Submit your application: Once you complete your application, you can then download, save, and print your EIN letter for your records.

You’ll need certain information to complete the EIN application, including:

- Your legal business name

- Address of the business

- Name and Social Security number of the responsible party

The responsible party is the person responsible for the company, which is also the person who will sign the application.

When you need to apply for a new EIN

If you make common changes to your business, like changing the name or address of your business, you won’t need a new EIN. However, if the ownership or structure of your business changes, you will need to apply for a new EIN.

Depending on your business structure, here are some instances when you’ll need to get a new EIN:

- Sole proprietorships: You hire employees or contractors or decide to open a business bank account.

- Partnerships: You will need a new EIN if you change the structure or one of the partners buys the partnership and plans to operate it as a sole proprietorship.

- Corporations: You’ll need a new EIN if you change the structure of your business, become a subsidiary of a corporation, or form a new corporation following a merger.

- Limited liability companies (LLCs): You will apply for a new EIN if you add more members to a single-member LLC or convert an LLC to a corporation.

On the other hand, you do not need to apply for a new EIN if:

- You change the name or location of your business

- Your corporation or partnership declares bankruptcy

- You elect S-corp taxation

If you elect a different taxation for your business, you will instead use Form 8832 to update the IRS.

Next steps for self-employment success

Your EIN is a nine-digit number unique to your business. An EIN identifies your business in the same way your Social Security number identifies you. The online EIN application process is straightforward, making it quick and easy to get an EIN. Plus, with payroll software like QuickBooks Payroll, you can use your EIN to pay employees and contractors.

Ready to get started?

Take routine bookkeeping off your never-ending to-do list with the help of a certified professional. At Eric Buchholz Bookkeeping, we can help ensure that your business’s books close every month, and you’re primed for tax season. Our expert certified QuickBooks ProAdvisors have over 25 years of experience working with small business bookkeeping across various industries.

Whether you’re weighing the benefits of having an EIN number, or where to apply for one, Eric Buchholz Bookkeeping can guide you down the right path. Schedule your FREE phone consultation today!… Simply CLICK HERE.